You can sign up for creditlimitincrease by phone or online. You will have to provide some details like your current income, monthly mortgage, and rent. Once you have completed all the details, you should submit your request. If your request is approved, you will be notified. But, before you submit a request, make sure you verify your eligibility.

Register for creditlimitincrease

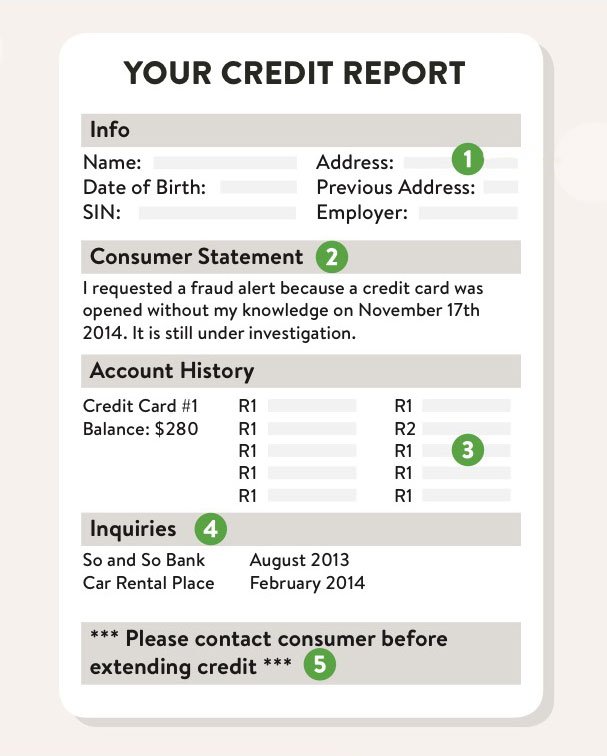

A few things to keep in mind when applying for credit limit increases are: First, verify your income. To verify your income and employment status, you should also review your credit reports to determine if any incorrect information is there. If so, you can dispute it with the reporting company or credit bureau. Equifax, for instance, offers a dispute section on its website.

You can get your credit limit increased by calling

To request an increase in your credit limit, you can call your credit card company. Online applications are also possible, but it is easier to speak with a representative. It is important to gather all necessary information before calling your credit card issuer. It is also helpful to have the credit card number on hand.

Before making your call, prepare some talking points. Talk about how much you earn per month, how responsibly you use credit, and even recent financial transactions. A recent promotion, raise or change in income can be used to strengthen your case. Be polite and try not to lose your cool, but be prepared to explain your financial situation to the creditor.

Online credit limit increases

Check with your credit card company to learn about their credit limit policy. Although most companies do not publish policies, there are some that will increase your credit limit automatically after a period of time. You can ask your credit card company for a transfer of your secured credit card balance to unsecured. This will increase your limit. Wait until your income is increasing or you have a strong track record as responsible cardholder.

Ask your credit card issuer if you can apply for a limit increase online. Most likely, you will be asked for a soft inquiry. This will not affect your credit score. Increasing your credit limit will help you reduce your credit utilization ratio. This will allow your balances to remain within a healthy level and give you more freedom with your day-today spending.

Checking your eligibility

If you are a regular customer of your credit card, most credit card companies will offer a credit increase. This is the fastest way for you to increase your spending power. It allows you to make smaller purchases while having a larger credit limit. However, you may not be approved for credit line increases like this.

First, you will need to have a credit score that shows you have always paid your debts on time. Typically, credit card companies check for several factors, including employment status and income. Some credit card companies will verify your current housing payment status.