For many, building credit fast can be a difficult task. This is especially true if your credit history is poor or non-existent. This process is not only time-consuming but also frustrating. Having good credit is necessary for a variety of financial goals, including renting an apartment, buying a car, securing a mortgage and even getting a cell phone contract.

It takes time to build credit, but you can accelerate the process with some smart tactics. Here are some of the best ways to build credit and the fastest way to improve your score:

1. Make sure you pay all bills on time.

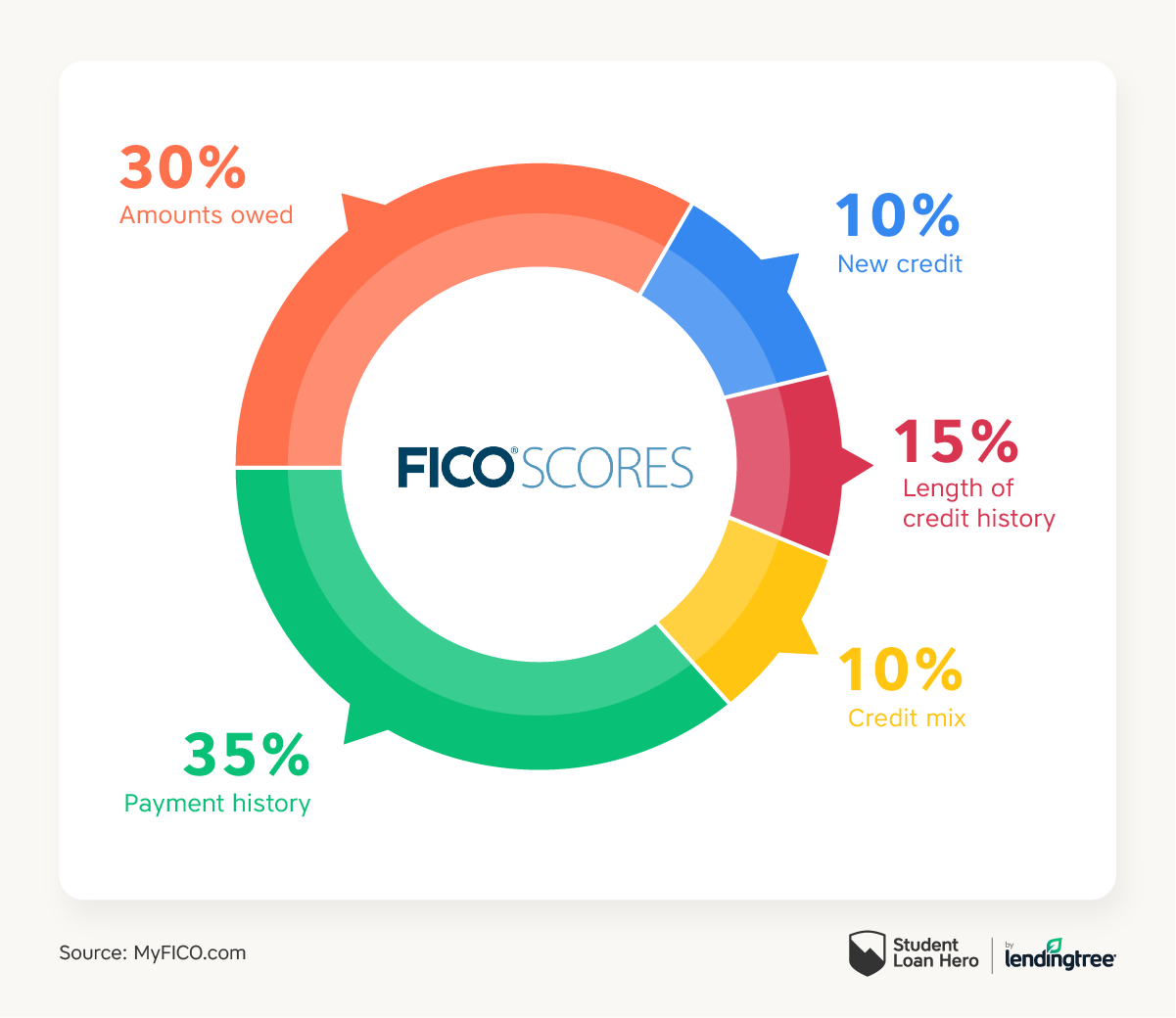

It's more than a convenience issue: on-time payment of your bills is the single biggest factor that impacts your credit score. It's a mistake to pay your debts late. This can damage your score for several years.

2. Avoid carrying a high balance on your credit card.

Credit utilization ratio should be kept as low a possible. It is the percentage you use of your available credit for revolving debts, such as lines of credits and credit cards. Having a credit utilization ratio above 30% can negatively impact your credit score.

3. A higher credit limit can be requested from your card issuer.

You could get a credit line increase if you are a regular customer who pays their bills on time. You should check your card policy before asking for an increase. Some cards will make a hard inquiry into your credit report, which could temporarily lower the score.

4. Use a secured credit card to build your credit faster.

If you're a first-time credit user, a protected card can make it easy to build credit and establish an excellent payment record. Secured credit cards usually offer a small credit limit in exchange for a refundable security deposit. After responsible usage, you can usually trade your secured card in for an unsecured.

5. You can take advantage of credit agencies' free tools and service.

There are many resources that you can use to establish your own credit. This includes websites where you can request free copies your credit reports, from Equifax Experian TransUnion. Credit agency services can be used to correct inaccurate information or dispute it.

6. Credit report cleaning is a great way to fix errors and late payments.

It is no secret that errors on your credit reports can negatively impact your score. However, it's very easy for these mistakes to be overlooked and not disclosed. To avoid this, it is important to review your credit report for any errors. If you find any, file a dispute and have them rectified.

Taking steps to resolve any errors or missing information on your credit report can have an immediate positive impact on your credit. If you are able to resolve the errors quickly, your credit score can improve by as much as 100 points.