You can build credit by getting a secured credit card. While they do not require a large security deposit you will be required to pay high late fees and interest rates. You should make sure that your balance is paid in full each month before you make a purchase. This will improve your credit score.

A security deposit of less than $50

A secured credit cards with a small deposit are a great way to increase your credit score. Secured credit cards require a small security deposit that can be refunded. These cards function much like traditional credit. They allow you to make purchases online and in-person, and you can pay bills. The best thing about this is that you don't have to do any credit checks before you start building credit.

Your key to building credit with a secured card is to be disciplined. An account with a credit limit exceeding $5,000 could lead you to overspend and cause financial problems. Credit cards with lower limits will allow you to avoid this risk.

High interest rates

Secured credit cards often have higher interest rates than unsecured cards. These rates can make them more expensive. The rates can be variable and range from eleven percent up to twenty percent. There may be annual fees or processing fees charged by the issuer. Additionally, credit limits on these cards will be limited to the amount that you deposit as collateral. This is why it is so important to shop around before deciding to apply.

It's good to know that most secured credit card companies offer a "graduation route" for cardholders who timely pay their bills. Depending on the card, this process can take as little as six to nine months, although some cards may take longer. This makes secured cards a great way to build up your credit and then upgrade to unsecured cards when you are ready. Pre-approval for secured credit cards is required by most. This involves an extensive credit check.

Late fees

There are ways to avoid late fees when using a secured loan card. Late fees can sometimes be waived entirely, while some have costs caps. If you are aware of these fees, it is possible to avoid them and show your financial responsibility.

To avoid late fees on your secured credit card, you can pay your entire balance each month. This will help you establish a positive payment history, which will boost your credit score and help you qualify for an unsecured card in the future. Remember that your payment record is the most important aspect of your credit score. Therefore, make sure you are punctual in your payments. The credit bureaus will report these payments and your credit score will rise.

Credit check not required

A secured credit can be a great tool to build credit, without the need to worry about your credit score. A secured card requires a small deposit such as $49 or $99, but no more than $200. Once the account is closed, the issuer returns the security deposit to the user in the form of a check or statement credit. Contact the issuer immediately if the money is not returned to you within 90 days. You can choose from a variety of secured cards that are available for people with bad credit.

Secured credit cards don't require a credit check, but you should keep in mind that they do require a security deposit, which acts as your credit line. If you default on payments, the issuer will seize your security deposit. Secured credit cards work just like traditional credit cards and can help you improve your credit score when used responsibly.

Building or rebuilding credit history

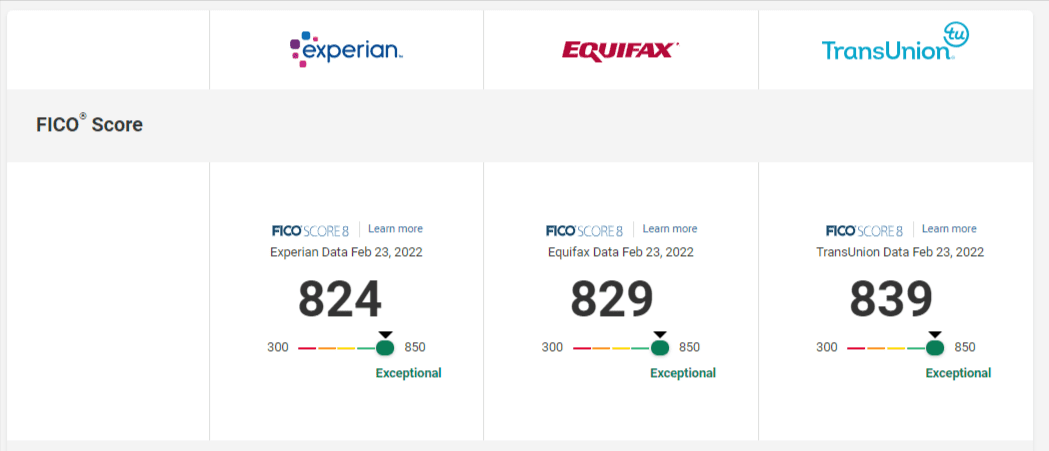

You might consider a secured credit credit card if you want to build or improve your credit history. This card reports activity to all three credit agencies, which can help boost your score. Paying on time is the key to building credit with secured cards. As long as you can afford to make the payments on time, you'll soon find yourself enjoying the benefits of an excellent credit history.

Secured credit cards can be a great way to build or rebuild your credit history. You can spend more money and not worry about your credit score because the credit limit is often equal to the security deposit. But these cards have their limitations and shouldn't be used for high-spending habits.