Reflex Mastercard credit cards are specifically made for people with bad credit. You will be able to double your credit limit within six months. To get approved, you need to have a check account. There is an additional fee for the annual renewal. This credit card is for those with poor credit.

Reflex Mastercard credit card is for people with low credit scores

Reflex Mastercard credit cards are available to people with bad credit. The card has a low interest credit line and a credit limit between $200-$1,000. This amount is increased automatically after you make six monthly payments. Reflex Mastercard has this feature, which is something that many cards don't offer. The downside is that the card comes with high fees and an annual fee.

Bad credit is not a good choice for the Reflex Mastercard. Although the initial credit limit is low, the interest rates are high. There are also strict requirements for eligibility, including an examination of your credit history. Pre-qualification may be an option for those who are concerned about their credit history.

After six months, your credit limit is doubled

The Reflex Mastercard credit card offers a credit limit increase after six months of on-time payments. This feature can improve your credit utilization and help you save money on interest. However, this credit card comes with a $30 annual fee for each authorized user. To avoid a high rate of interest, you must always pay off your card's balance in full each monthly.

Reflex Mastercard, an unsecured credit card, is not intended for people with good credit. This card is for those with low credit scores and a credit limit less than $1,000. Your credit limit will double if you follow the guidelines and have good financial habits. This card also reports your balance and payment history to all three credit bureaus.

It charges an annual fee

Reflex Mastercard charges $30 an annual fee. However, after six months of on-time payments, your credit limit will be increased automatically. This is an important feature for those who are concerned about credit utilization. However, if you aren't able to make your payments on time, you may end up paying late fees. Late fees can add nearly 30% to your account. In order to avoid paying high interest rates, it is crucial to pay your balances every month in full.

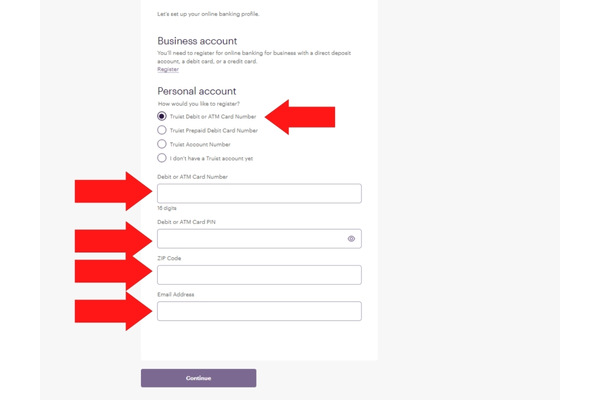

Reflex Mastercard's application process is simple and fast. Before applying, you can check your credit eligibility by completing the free pre-qualification application. It won't affect your credit score and only takes a few moments to complete. Once you're approved, you'll be sent your new card and be notified of your decision. Your card can be activated within 7-10 business days.

To be approved, you will need a checking account

Reflex Mastercard is a Celtic Bank credit card. It comes with a variable-interest rate and a very small credit limit. This card is ideal for building credit, even if you don't have a bank account or have poor credit. By making regular payments on your balance, you can increase your credit score.

Applying for a Reflex credit card can be completed online or over the phone. In order to apply, you need to give your Social Security number and date of birth. You also need information about your employment. Once you have submitted the application, you should receive a response within two to three working days. Reflex Mastercard offers multiple benefits, including no monthly fees.

It provides $0 in fraud liability

Reflex Mastercard offers several benefits, including zero liability if fraudulent transactions are made. Open an account to be able use in any Mastercard-accepting establishment. After six months of on-time payments, you may be eligible for a higher credit limit. Your credit score is calculated by your credit amount. A higher credit limit can improve your score, and help decrease the amount of credit that you need. Reflex Mastercard also sends your activity to each of the major credit bureaus every month so that you can quickly see an improvement in your score.

Reflex Mastercard will charge a $30 once-off fee. Experian will also provide a VantageScore 3.0 credit rating for free. Additional, you will get free estatements, which contain your VantageScore 3.0 score. This feature is a great way to have peace of mind with your Reflex Mastercard.