You are not the only one who wants to improve credit scores. There are many different ways you can improve your credit score. Let's take a look at some examples: Applying for a credit card, disputing inaccuracies in your credit report and opening a non-revolving credit line.

Repaying debt on time

One of the most important things that you can do to raise your credit score is to pay down your debt on time. Your score is calculated using several factors, the most important of which is how much you owe. A lower credit card balance can boost your score and allow you to qualify for lower interest rates. Paying down your entire balance quickly is a good idea if you don’t have enough cash.

Your goal should be to keep your debt levels below 20% of your credit limit. This will reduce your credit utilization ratio (the amount of credit you have available minus what you owe). Keeping your balances below 20% will raise your score. You can also set up alerts for reminders and help you remember when your payments are due. Call your credit card company and request a higher limit. This shouldn't take more than one hour.

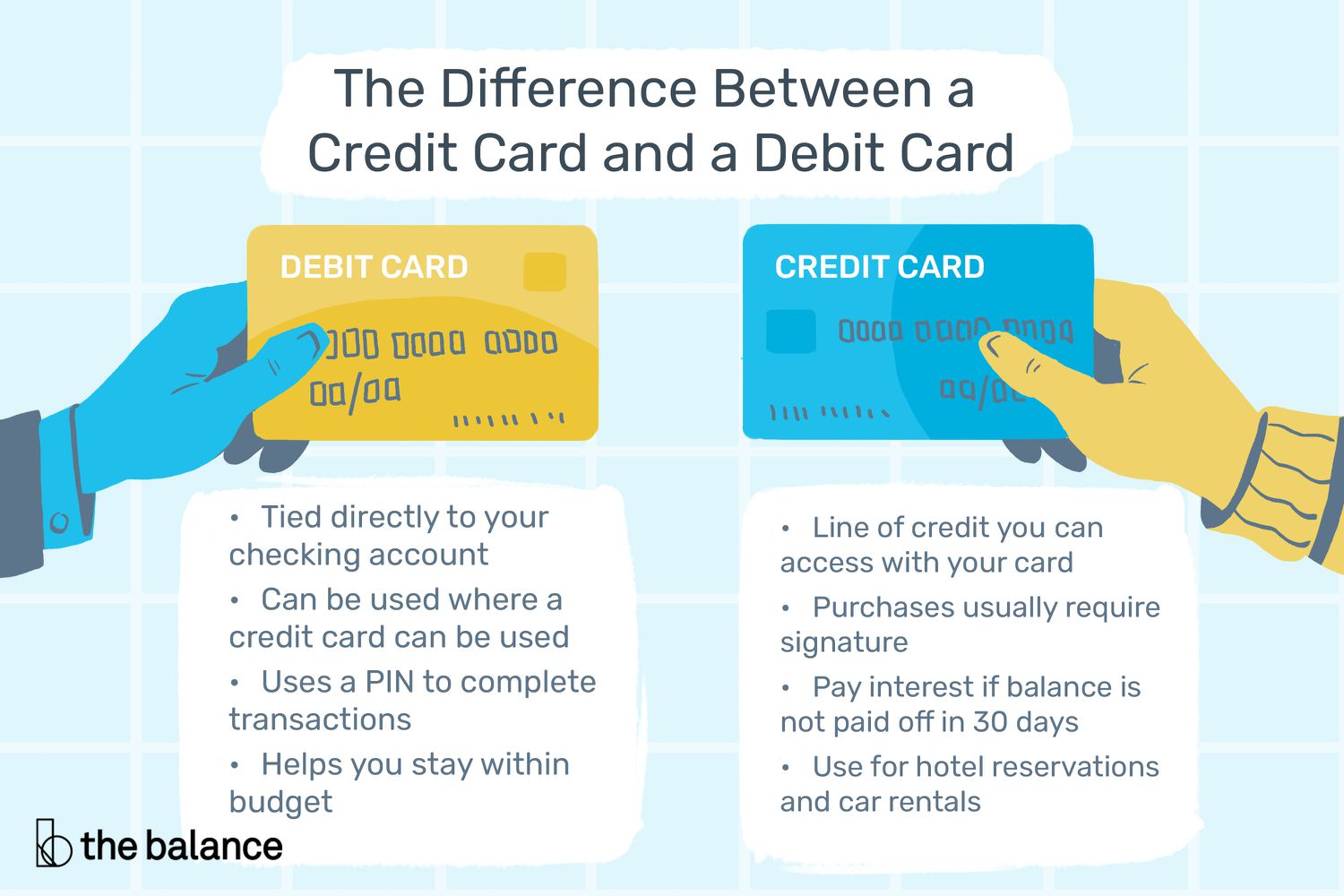

Applying for another credit card

You can take a few steps to improve your credit score quickly. First, avoid applying for new cards with annual fees. The annual fee may be worth the cost if you are able to access the rewards program on these cards. Second, don't make large increases to your credit card spend when you get new credit cards. This will lower your credit utilization which will improve you score.

Third, limit the credit card you open to 30 percent of your available credit. This will lower your credit utilization rate to below 20%. You can improve your credit score by only using a small amount of your credit. You shouldn't use all your credit. It can make you look risky.

Dispute credit reporting inaccuracies

If you discover incorrect information on your credit card report, you can take steps to dispute it. Online or at your bank, you can file a dispute. You should also include copies of supporting documents. Credit scores can be affected by how quickly a dispute is resolved.

Follow up with the credit bureau if your dispute doesn't result in a reasonable time. You should receive a written reply and an updated copy your credit report. However, the dispute will not affect your annual credit report. It can however appear on future reports. To get a copy, you might have to pay a fee. You can refer to the sample dispute letter provided from the credit bureau to ensure you get the right response. Be sure to send the dispute letter by certified mail or with a return receipt.

A non-revolving credit card line

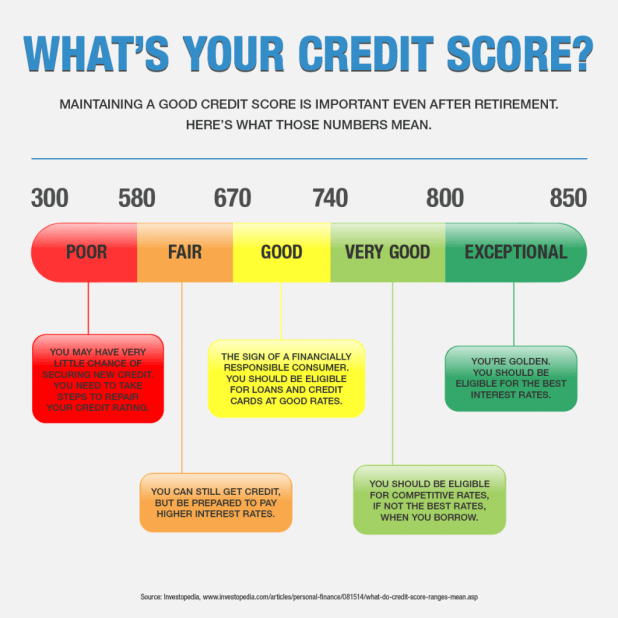

Credit scores show how attractive a borrower can be to lenders. Although there are many different formulas used, most lenders look at five factors when calculating credit scores. One of these factors is how much debt the borrower has relative to the available credit. Credit score can be improved by lowering your credit utilization. You can also increase your credit limit by paying off your outstanding balances.

Inactivity on credit card accounts can affect credit scores. FICO is interested in recent activity on revolving credit accounts. While not every card has to have a balance, a lack of activity on any card can lower your score.

Applying for a secured card

Secured credit cards can help improve credit scores if you are having trouble getting credit. Secured cards require a deposit and report a good payment history to the credit bureaus. However, you should use the card responsibly, and try to keep your balance below 30% of your credit limit. There are many types and options of secured credit card.

Secured credit card require a deposit equal the amount of credit you will be granted. It is a good idea to save some money for this deposit. After approval, select a card that has low deposit requirements and offers good credit lines. To avoid interest accruing, ensure that you pay your balance every month in full.