Credit cards for poor credit are available online, and you can get one for a low annual fee and 2% cash back on purchases. This type of card has a high approval rate and is perfect for re-building credit. These cards send monthly reports to all major credit bureaus. If you already have one, it is important that you responsibly use it. Making payments on time and staying out of trouble with your account will help you start building your credit score again.

Common questions regarding credit cards for 500 credit scores

People with a 500 credit score or less often have difficulty getting loans or credit card approvals. Lenders consider these people to be a higher-risk group due to their poor credit record. There are still options for those with low credit scores. There are a number of credit cards for people with 500 credit scores.

One option for people with 500 credit scores is to apply for a secured credit card. Many cards offer no annual fee and rewards on purchases. These cards can be used to improve credit scores.

For people with poor credit, unsecured credit cards may be better

There are two types if credit cards: unsecured and secure. An applicant must make a deposit to secure a card, while an applicant for an unsecured card is not required. Although unsecured credit cards offer better options for people with bad credit scores, they can come with high-interest APRs as well as costly fees. You should always check your credit score before deciding which credit card is right for you.

Chase Freedom Unlimited card is an excellent example of an unsecured card for people who have poor credit. This card is available to students. This card is for students with a low credit score who can still afford the monthly fees. It even has a handy assistant to track your due dates.

For a credit card with 500 credit score, you will need to meet certain requirements

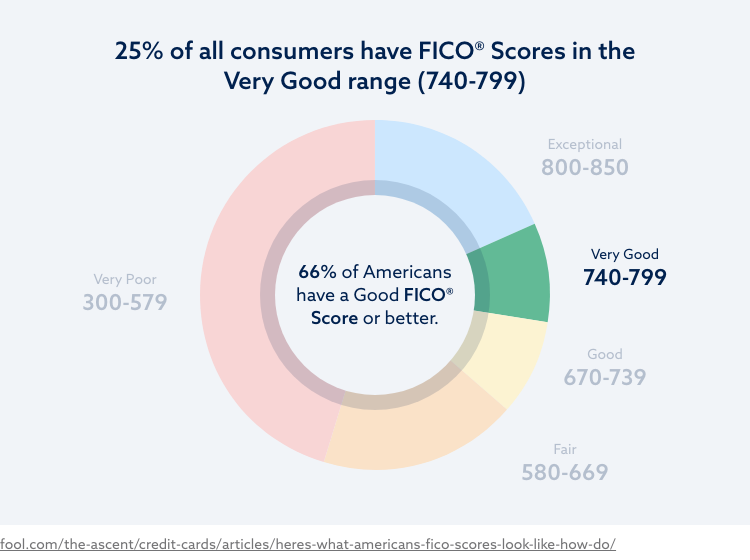

If your credit score falls below 500, it may be difficult to apply credit cards. Your credit score is the best way to increase your chances to get approved. A higher credit score means more credit options and lower interest rates. Additionally, they are more likely to be approved because there is less collateral required.

Even though a credit score below 500 is considered poor, you can still obtain a decent credit card and repair your credit over time. First, make sure you choose a credit card that reports your progress directly to the major credit reporting agencies. Avoid missing payments and maintain a low credit utilization. These simple steps can help improve your credit score in a matter months.

Credit card with a 500 credit history offers rewards

Although it is possible to get a creditcard for those with 500 credit scores, it can prove more difficult than for those with higher credit scores. Credit scores less than 600 are considered "poor," while scores above 500 are considered to be "very poor." Poor credit scores are not necessarily impossible. However, it can make your financial life more difficult. There are a few key steps that you can take to improve your credit score.

Secured cards are another option. These cards typically have no annual fees and reward cardholders with 1 - 2% cashback for purchases. Secured cards can be a good way to build your credit score. These cards report your purchases to all major credit bureaus monthly. This gives you a great chance of being approved. As long as you use your credit card responsibly, you will be on the road to good credit. Making all of your payments on time is crucial to repairing your credit.