It doesn't matter whether you're trying to find a new card or refinance your existing mortgage, it is vital to understand the contents of a credit file. This information is linked with your Social Security number. You can also see your name, date and employment history. You can also access your credit account history. This will be the largest portion of you report. The account history contains information such as the date you opened it, how much you owe, when you closed it, and so on.

Information about credit reports

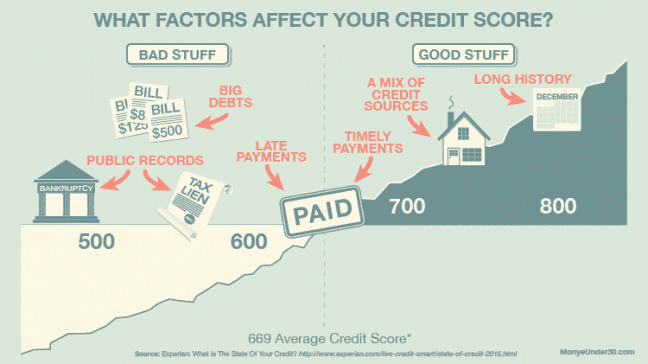

In general, information on a credit file will include information about how much credit you have and what debt you have. This information is used to calculate your credit score. Also, the amount of credit available to you and each account's payment history will be considered when calculating your score. Your payment history records the amount owed as well as the late payments.

Your credit report contains many details about you, such as your name, birth date, and employment status. The credit report also includes information on your credit accounts including credit cards and auto loans as well as mortgage loans and mortgage loans. You can look at your credit reports to see which accounts are missing and make corrections.

Example of a credit report

In a credit report, you can find information about your open and closed credit accounts. This includes account numbers, the type of account, and how much you're paying monthly. It also has sections for inquiries and credit limit information. You can also see if there have been any late payments in your credit history. You can also see names of creditors and other individuals who have inquired regarding your credit.

These reports are compiled by the major credit reporting agencies. Every report includes details about credit history. These include the number and status of your open and closed credit accounts, the amount of missed payments and collections filed, as well as information on how many times you applied for credit. These reports can be kept on your credit file for many years. Financial institutions use it to determine if you are a suitable candidate for loans. It is also available for insurance companies, employers, as well as landlords.

How to access a credit report

Your credit score is an important part your financial life. It's up to you to find out what it contains. This information is used to determine whether or not you are eligible for credit cards, loans, or jobs. It is used by potential lenders and creditors to decide whether or not to lend you credit. To make sure that the information is accurate, you should check it at least three times a year.

This report includes personal data and a summary credit history. It can be obtained at the Equifax or TransUnion credit bureaus. Information will be reported to these agencies by most banks and departmental shops. But you need to remember that not every creditor reports to these agencies.

Importance of monitoring your credit report

Your financial health is dependent on your credit score. It will alert you to any modifications in your credit report such as new accounts or loan applications. This information will help you prepare for future loans and improve credit scores. To receive alerts when you are issued a loan application, credit card, or new credit card, you can create alerts.

If you are worried about identity fraud, it is worth monitoring your credit score. This will help you spot potential errors and reveal the true status to your credit. You could have incorrect information due to identity theft or human error.