If you're behind on your payments, it is best to pay the full amount. Talk to your creditor if you're unable or unwilling to pay the full amount. Most creditors will negotiate with you to lower your monthly payments.

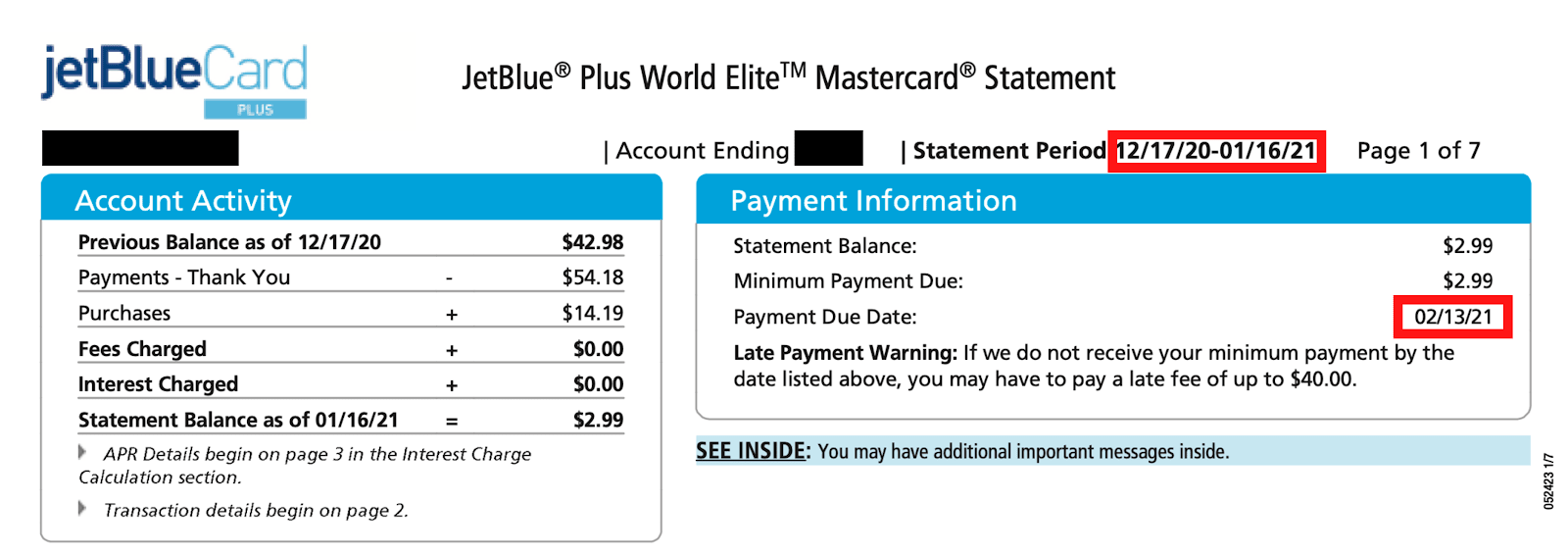

Fees imposed for late payments

Late payment fees are a powerful tool to increase payment speed and to encourage customers to pay in time. A fee will automatically be applied to an invoice after it has passed its due date. In some cases, you can offer a grace period for payment before the late fee kicks in. Many accounting software can be set up to automatically add late fees to invoices that are past due.

Late payment fees are still one of the biggest sources of income in the credit card industry. In fact in 2017, credit cards were owned by over 175 million U.S. citizens. The CFPB reported that the cards generated more than $12 billion in late charges. Although late fees have been around since the beginning, their popularity is increasing.

Late payments can have a negative impact on your credit score

Late payments can cause severe credit scores problems. A missed payment could leave your credit score for up to six-years, making it more difficult to get loans. There are many ways to mitigate the negative impact. Although a late payment can seem severe, your credit score will rebound with hard work and patience. Your credit score will be improved if you make minimum payments. You can also reduce your debts by actively paying down your balance.

After one late payment, your credit score could drop as high as 180 points. If you make multiple late payment, your score may drop even further. Your score will fall by approximately 10 points each time.

For late payments, there are many options for remedy

Late payments can happen for many reasons. Sometimes you're unexpectedly laid off, or you simply can't afford to service all of the bills from your salary. You're likely to find yourself in a sticky situation with your creditors. Fortunately, there are remedies available.