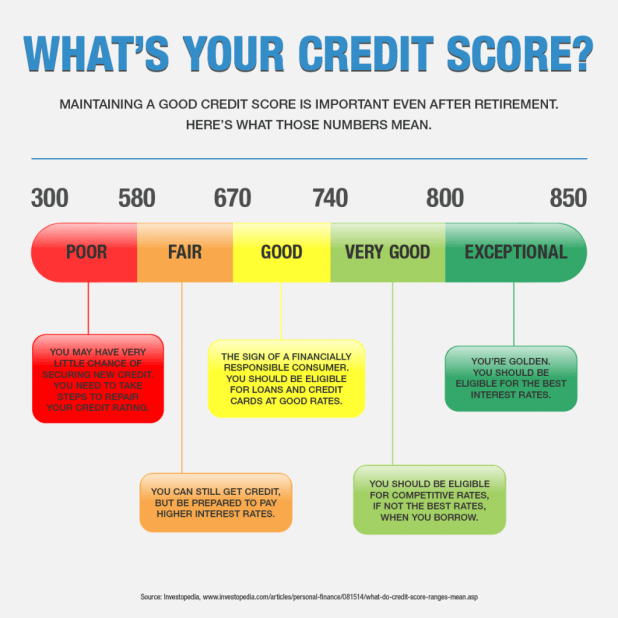

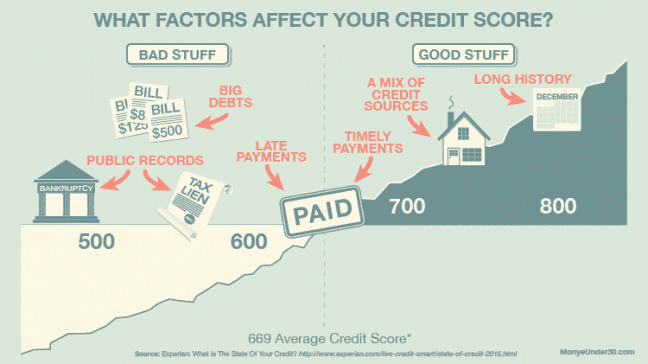

Credit bureaus assign scores on your credit report based primarily on how you have paid your bills and the amount owed. They also consider the time period since you last applied for credit. These scores are used by lenders to predict your ability to pay your bills on-time. They range between 300 and 850. A higher score signifies that you are able to pay your bills on time. Credit bureaus are responsible for analyzing, synthesizing, and presenting this information to lenders and other businesses.

Equifax, Experian, and TransUnion are the 3 main credit bureaus

Credit bureaus monitor your credit history and determine whether you are a risky borrower. There are many credit bureaus out there, but most lenders will use one or two of the major three. Equifax, for one, was started in 1899 as a retailer credit company and had branches across North America by the 1920s. Credit files were maintained for millions of Americans.

Each bureau operates with a different business model and provides different credit monitoring services. TransUnion is primarily focused on consumer data. Equifax sells consumer data to retailers and government agencies. Both companies also offer credit monitoring and other services to the public.

They each have free annual credit reports

To get your free annual credit report, simply call the toll-free number or go online. Within 15 days, you will receive the report. The report can be requested at intervals of up to four month, or in staggered order. But, credit reports are not a complete view of your credit. Monitoring services can be purchased for as little as $40 or more per year.

The information reported by all three credit agencies may be the same, but it could differ from one bureau to another. This is because individual creditors do not have to report to all three bureaus. Some mortgage companies may only report to one bureau. So, it is important to check all three to see if there are any discrepancies. This could negatively impact your credit score.

They each have a background check

Check your credit report to find out if anyone has been convicted. This is a great way to avoid identity theft and fraud. These reports are useful for many purposes such as loan applications, utility deposits, etc. They provide identifying information, a list past and current credit accounts, as well payment history.

Equifax, Experian, or TransUnion all provide credit reports. Each bureau may have a different way to calculate your credit score. This information could also differ from one another. You need to understand the limitations of each bureau in order to safeguard your credit score and maintain good credit.

Each have a VantageScore credit scoring method

While FICO scores are still widely used, VantageScore credit scoring uses a more detailed model. It includes factors such payment history, age, and credit account types. VantageScore also measures credit availability and trends. It is free of charge and available on Credit Karma.

VantageScore was first created by three of the major consumer credit reporting agencies in 2006. VantageScore 3.0 is the latest version. It was first released by the three major consumer credit reporting bureaus in 2006. It quickly became the most widely used credit scoring model, helping over 40 million Americans to improve their scores. VantageScore 3.0 was the latest version released in 2017. However, many lenders still prefer VantageScore 3.0 to approve loan applications.