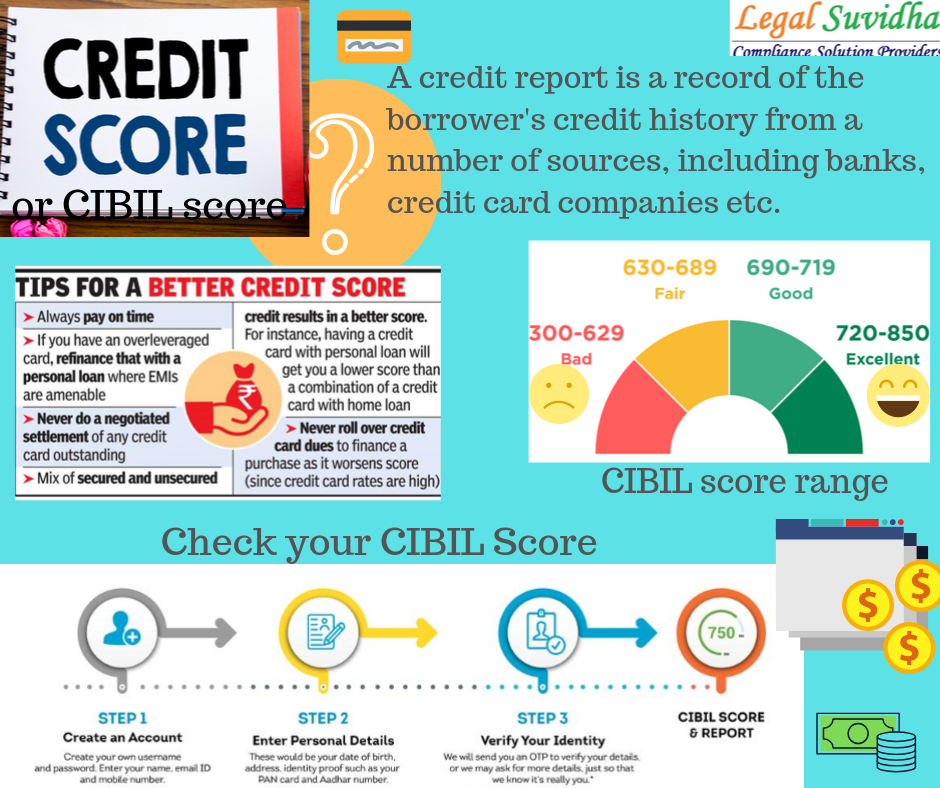

What is an appropriate credit score for me?

Having a credit score is critical for managing your finances and getting the most out of your financial life. Good credit scores can help you secure the best rates and offers. Experian can provide you with your credit score for free by requesting an annual credit report.

Average credit score 25 years old

Consumers between 25 and 29 years old have an average credit score of 662. This is based on two years' credit history, with less than ten lines of credit. While it can take time to establish a credit rating, it is important to start immediately working to improve your score.

What's the best credit score a 20-year-old can have?

Young people have a limited amount of credit history and are often first-time users of credit. You should start building credit as early as possible if you plan to apply for your first card or loan.

What is a credit score that a teenager should have?

You should avoid late payment and use your credit card responsibly if you are a teenager. The largest portion of your credit score, 35%, is based on payment history, so making sure you're paying your bills on time can have a huge impact on your credit score.

As you age, your credit score will also rise. This makes sense because older consumers tend to have more experience with credit and a longer history of it. It's also a good idea to check your credit report and make sure any negative information is removed as it ages.

What's considered a high credit score?

A credit score above 700 is considered to be good. A credit score of 700 or more can lead to a better rate of interest and greater rewards for your credit card. You can also get a high score by being in a better income bracket and paying your bills promptly.

What's an acceptable score for someone 60 years old?

For people in their 60s, 707 is a good score. You should also pay on time. You should also avoid taking on excessive debt as it can affect your credit rating.

What's the best credit score for a 65-year-old?

A FICO credit score of 760 or "very good" is considered excellent, and it's an important step toward obtaining the most competitive interest rates and terms. If you meet specific criteria such as having a strong credit history and a low debt to income ratio, you can also receive additional rewards.

What's a good average credit score for 19 year old?

A good credit score is approximately 725 for a person aged 19 years. By making timely payments, you can increase your credit score up to 750.