Businesses of all sizes can apply for business credit cards. They offer a variety of practical benefits, as well as the opportunity to improve credit. However, they can be quite costly, especially if your spending exceeds the limit. Before making a decision, compare different business credit cards. Here are some things you should remember when applying to a business credit line with bad credit.

For all businesses, there are business credit card options available

A wide variety of lenders offer business credit cards. It's easy to apply. Similar to applying for a personal credit cards, the process for business credit cards is also similar. Your employer identification number (EIN), and your Social Security Number will be required. The application process to apply for business credit card cards is automated and usually results in an immediate credit decision.

Check your credit score before applying for a business card. Your chances of approval are greater if your personal credit score exceeds 700. Companies with a credit score of 700 and above will typically be eligible for the highest offers. WalletHub lets you check your credit score for free.

They offer many practical benefits

Unsecured credit cards can be tempting but they are not suitable for people with poor credit. These cards do not offer as much flexibility as secured ones. This can lead to overspending. There are business credit cards available for people with bad credit. These cards can offer you attractive rewards and practical benefits. These cards can be used for credit repair and small business loans.

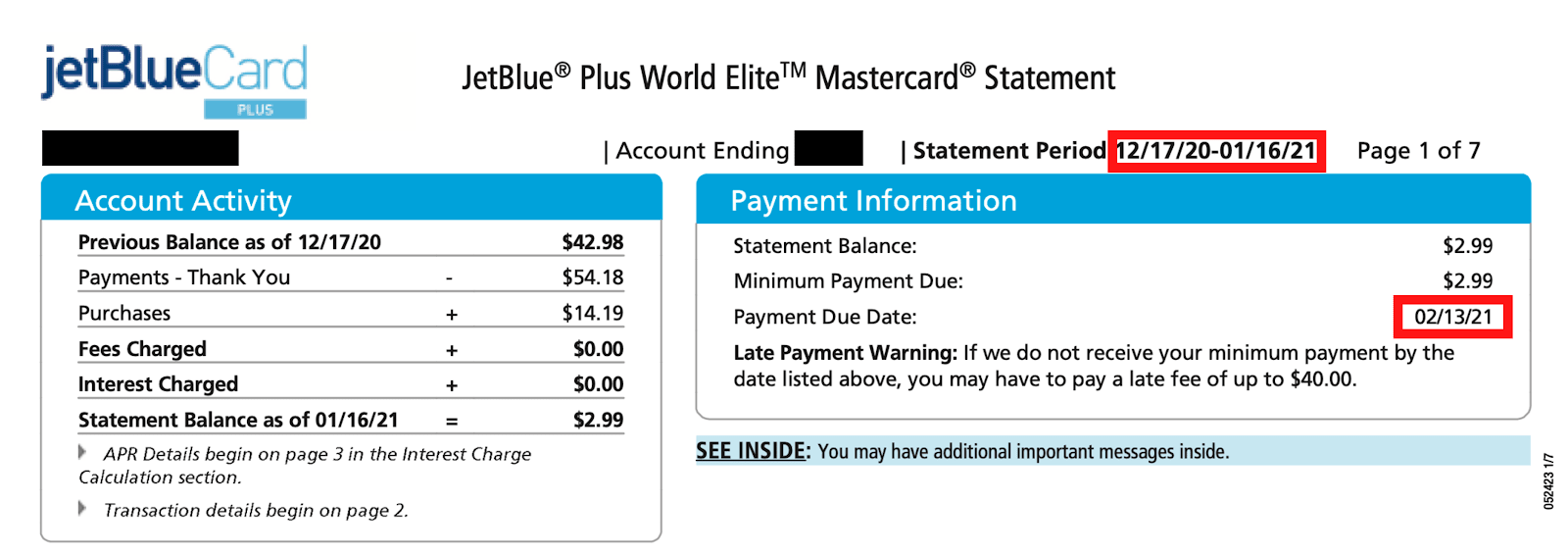

A business credit card allows you to pay off your debt more quickly and has a low interest rate. If you are not able to pay off your balance, it can grow over time, increasing your debt. Missing a payment can result in a late fee or an interest rate increase, and a ding on your credit report.

They can be a great way to build credit

One of the best ways to build business credit is to open a business credit card. These cards can be used to make monthly purchases and can even come with rewards programs. These programs can be especially helpful for certain types of businesses. Although credit limits may not be as high when you first open your business, your credit score will increase and you can increase them.

Remember that you can lose your personal credit score if the card is not used responsibly. Lenders often run hard credit inquiries when you apply for a business card. Hard inquiries can cause damage to your credit score.

You can end up spending a lot on them if you don't budget properly.

A business credit line with poor credit could cost you a lot of cash if you do not use it properly. For most business credit cards, you need to have good credit. This usually means that you need a minimum FICO score below 680. However, some business credit card issuers will work with people who have a lower credit score. Other options are available such as secured cards which require a deposit equal to the credit limit.

Business credit cards are useful for business owners because they offer a flexible line of credit and convenient payment options for business expenses. Some cards also offer cash back rewards and other incentives. These cards are only meant to be used for business purposes and should not be used to make personal purchases. Additionally, this card can make it possible for you to be personally responsible for any debts you incur.