Credit cards are not always easy to obtain for younger generations. These cards are convenient and offer protection. It depends on your financial situation as well as your financial goals whether you open a new credit line. Credit cards are a great tool to build your credit score. It is possible to open only one account, and then use it responsibly.

A credit card can help you build credit by opening one at the age of 18.

Opening a credit account early is the best way to begin building credit. Getting a credit card at an early age will help you establish good habits and increase your credit score, and you'll be less likely to be turned down by a creditor. You can also use these cards to develop good budgeting habits. Some cards are even targeted towards young people. Some cards will remind you of your bills, track your credit score, or reward you for paying on-time.

It is a good idea that you keep an eye on your statements and report any unauthorised charges to the credit card issuer as soon as possible. Most credit cards come with zero liability guarantee, which means you are not liable for any fraudulent charges. Even though getting a credit line at 18 isn't a top priority, it's a great way for young people to begin building credit.

Multiple credit cards can boost your credit score

It is okay to have multiple credit cards. However, it is best not to exceed your credit limit and to make timely payments. A single card with a low balance can be just as beneficial for your credit score as five cards with a high balance. It can be difficult to manage multiple cards. You may need to log on to multiple sites and apps in order manage your cards. Every card has its own payment due date.

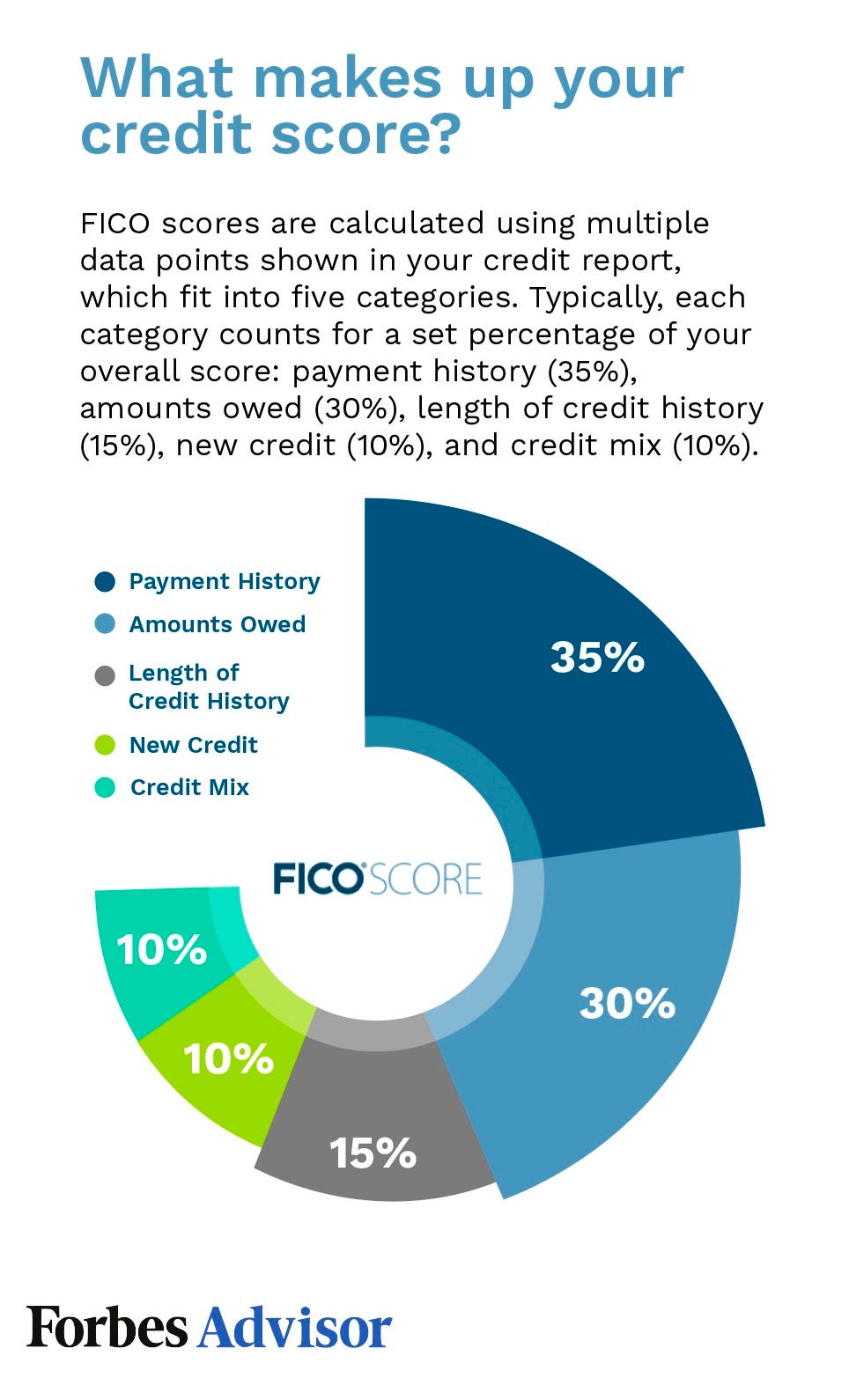

A number of credit cards can help improve your credit score. They also reduce your debt-to credit ratio. This is the ratio of how much credit you currently use to your total credit limit. An average debt-to–credit ratio of 30% is considered acceptable. This means that you should limit your credit use to no more than one-third. This is important in order to improve your credit score as well as get better credit.

Credit cards with no annual fees

People who don’t use their card often or don’t wish to pay an annual fee for credit cards can find it a good alternative. This type of credit card offers strong rewards and a no-annual-fee introductory period. However, new card users should note that they are still responsible for paying their monthly minimum payments and keeping track of their spending and earning thresholds.

You could save as much as $25-$1000 per year by getting a card with no annual fee. A $1,000 annual fee may seem small, but it can play a major role in choosing the right card.

Customers with damaged or limited credit can apply for a secured credit card

If you're looking to get credit cards, but have damaged or limited credit, a secured card might be a good option. These cards offer great short-term solutions and can help build credit. Pay your bills on time and you might even be able get a better credit line within six months. You will also be reported to credit bureaus.

Secured credit cards require a deposit of a certain amount of cash. The amount varies depending on the card issuer, but may be as low as $200. This deposit acts as collateral for your credit card. You could lose your deposit or damage your credit score if you fail to make a payment. The issuer might take your deposit and close your account in the worst case scenario.