To start your credit report fresh and improve credit score, you need a first-time credit card that has no credit history. Your credit score will improve over time if you do this correctly. The Ascent compiled a list that includes the best credit cards issuers.

Get rewards for your first credit card

To help you build credit, you can apply to a Discover rewards creditcard even if your credit score is not good. With no foreign transaction or annual fees, an unsecured card can be upgraded as long you pay your bills promptly. You can also get the card without paying a late payment penalty fee the first time you use it.

Discover has a range of rewards credit cards that are suitable for different financial situations. Although some cards do not offer one-time bonuses they offer benefits such double cashback after the first year. This is an important benefit, especially when you use the card well. Other features include unlimited earning opportunities, flexible rewards redemption, as well as 0% APR during the first 14 months.

Discover gives you the opportunity to earn rewards from every purchase. The cash you receive can be used for statement credits, cash, or both. Redeem your rewards online, or by phone. There is no minimum amount required to redeem your rewards. All of your rewards can be redeemed at once. Cash redemptions can be made in any amount, but credit must still be maintained.

Secured credit cards

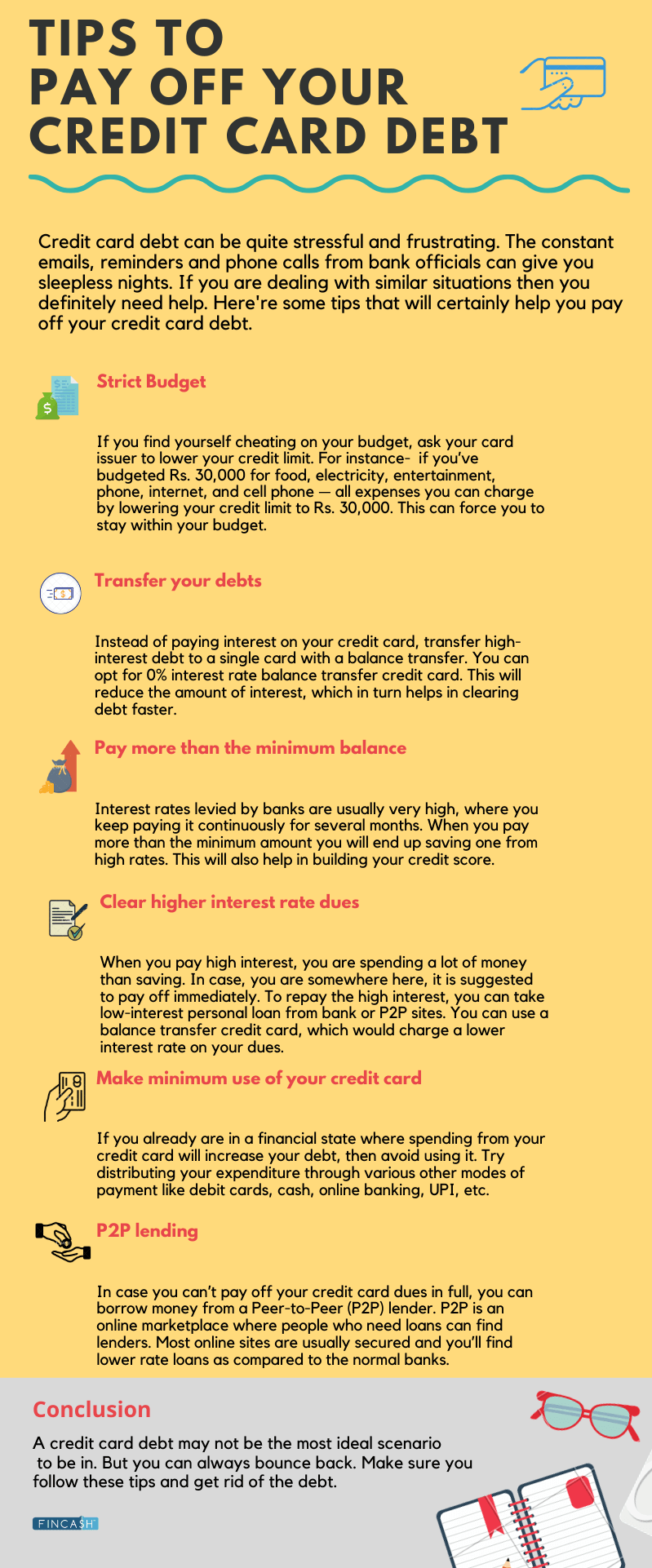

Credit cards that are secured can help you build credit. You won't be denied for having derogatory marks on credit reports, unlike unsecured credit cards. This means you'll have a better chance of approval, and you can avoid interest charges, which can seriously harm your score.

Secured cards also offer other benefits. Some of them have rewards programs and credit score tracking. Some of them offer cashback rewards. These rewards are typically modest at around 1% and sent to you in the form of a check at year's end.

You will need to deposit a small amount, typically a few hundred to thousands of dollars, in order to be eligible for a secured account. The annual fee can also reduce the balance. A $400 deposit will give you a $400 spending cap, while a $75 fee will bring it down to $325.

Cards for Department Stores

Department stores offer credit card options to boost customer loyalty and increase their revenue. They also give credit card users incentives to shop at their stores, including cash back and other benefits. Be sure to review the eligibility requirements before applying for any of these cards.

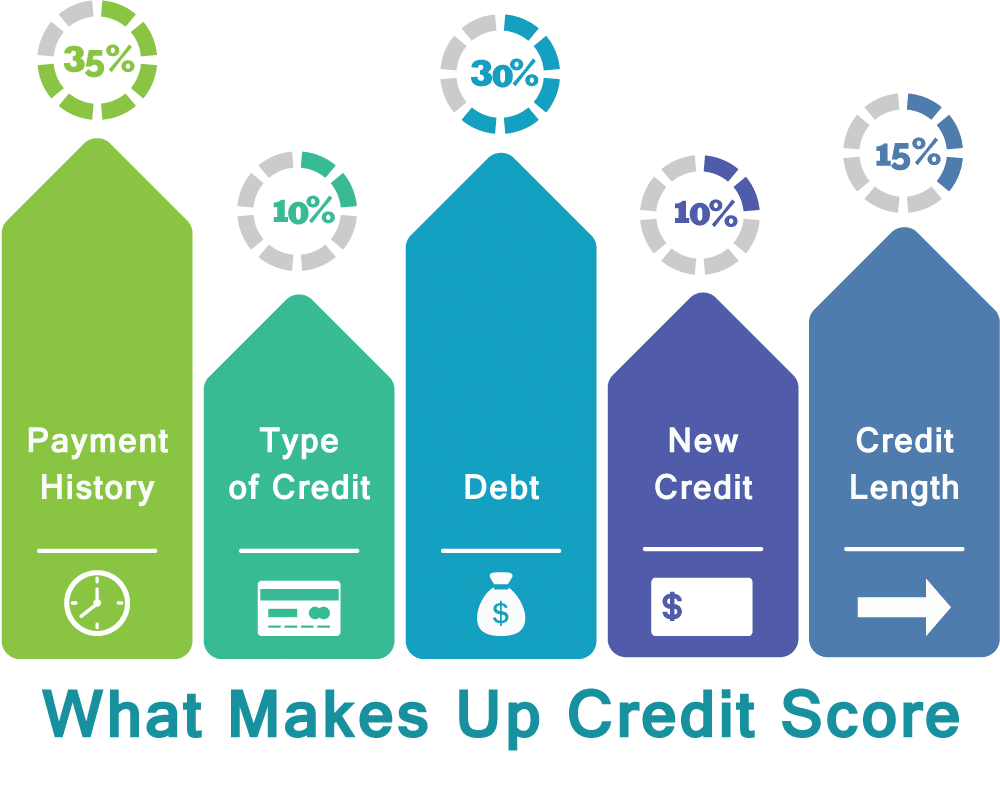

Department stores often offer store credit cards with very low credit limits. These cards may have a negative impact on your credit score due to the high utilization rate. Credit scoring models take into account the utilization rate on your cards. So, having a store credit card with a low credit limit could lower your score.

Bad or poor credit may find department store credit cards a good choice. These cards offer numerous rewards and are easy-to-get. For you to be eligible to apply, your credit score must be good or acceptable. However, if you're applying for a store credit card without a credit history, you should be aware that most of them trigger a hard check. Applying for a JCPenney creditcard will require you to provide information about income and housing costs.