There are many credit score options. You can make informed decisions about finances by understanding which range of credit scores is right for your situation. TransUnion credit scores provide an example. Credit scores are used to provide lenders with a snapshot of the consumer's credit health. These scores can be used freely by lenders in evaluating a consumer’s application for credit. There are however important differences between TransUnion credit scores, and FICO scores.

VantageScore

The VantageScore credit score can range from 300 to 850. The most common version is 4.0, which includes 24 months of historical data, non-traditional data, and traditional FICO factors. VantageScore is more flexible than FICO. It is especially helpful to those just beginning credit history. How do you find out where you stand? Discover the advantages and disadvantages to VantageScore.

The VantageScore Credit Score and FICO credit Score ranges are designed to help consumers understand how important it is to know your credit score and what lenders look for in a loan applicant. These two scoring models are the most widely used today, and they both have different ranges of scores. Your score can be used to help improve it. Understanding the range is key. While some lenders may consider your score as "good" if it's in the higher range, others will rate you as a high-risk borrower.

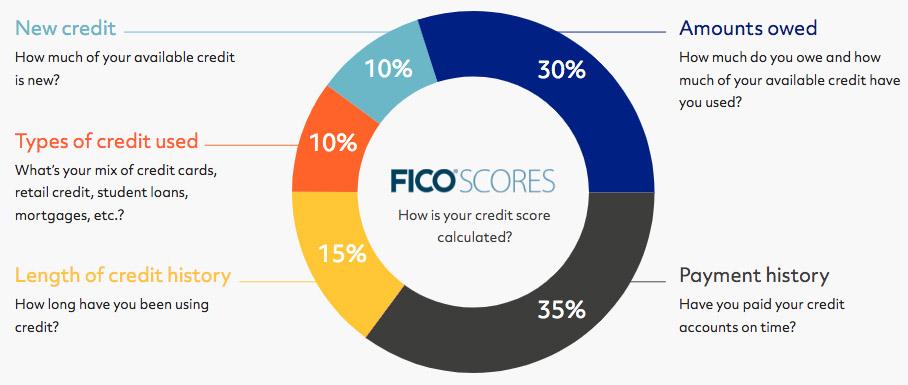

FICO

As you may have noticed, the TransUnion and Experian credit scores ranges are very similar. But they do have different ways of calculating your score. Both bureaus employ a variety of methods and scores can vary by as much 50 points. Here's the information you need. You can start to build your score by learning what other credit bureaus use for determining your credit scores.

Equifax also offers a proprietary credit score (Equifax VantageScore) that ranges from 300 to 850. The only difference is that it uses an entirely different model to calculate. Credit Karma offers a free service that allows you to check your score. The TransUnion FICO credit scores ranges are slightly more specific. If you are concerned that your score may be lower than those from the other two bureaus it is recommended that you obtain a copy at each agency.

Experian

The three main credit reference agencies Experian TransUnion and Equifax determine your credit score. These agencies use different scoring systems to calculate your score. The best score for credit is between 881 - 960. A score of 850 or higher will help you qualify for a lower rate and a greater loan amount.

Both CIBIL and Experian credit score ranges can be as low as 330 or as high as 830. Your credit score can range from 300-850 depending on the credit history. You may receive a different credit score depending on your age and financial circumstances. That is completely normal. If you are in a difficult financial position, it is possible to increase your score without affecting your credit report.

Equifax

Equifax's personal credit score tells lenders a lot more about you and your financial situation. It's based on a variety of factors including how many credit cards you have, how much each one has cost, and how often you've inquired. If your credit score falls, it means that lenders are more likely than usual to reject you. Here are some steps you can take to improve your Equifax score:

Equifax has a variety of credit score ranges, but most consumers know the basics. There are two main credit score ranges available: excellent or very good. A high score, 700 or higher, indicates lower credit risk. The average range lies between 500 and 575. 700+ is considered a good credit score. If you are within one of these credit ranges, it is likely that you will be able to get approved for credit or pay off any existing balances more easily.