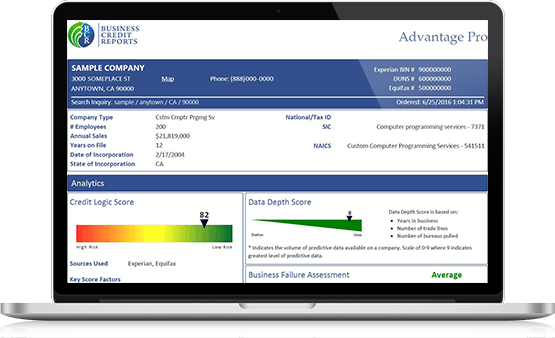

If you're looking for a credit card with low interest rates and no annual fee, you might be interested in First Progress. This credit card is available to residents of all 50 states. The card comes with a $200 refundable deposit, and you can add up $2,000 if necessary. The deposit can be increased at anytime, but First Progress must first approve. After approval, the deposit will automatically be credited to your account and you'll receive a check within 10 working weeks.

Low interest rates

First Progress Platinum Select Mastercard, a secure credit card, requires a $200 deposit. You can also deposit more money, up to a credit limit maximum of $5,000. The $39 annual fee is quite low and offsets the higher interest rate.

The First Progress Platinum Select Mastercard is a full-featured card with low interest rates. The card is issued with a non-refundable security deposit, and it reports monthly to the three main credit bureaus. A new credit history will be established if you are able to make all of your payments in time. You'll also be eligible to upgrade to another credit card after six consecutive months of making on-time payments.

No sign-up bonuses

You should know the details of each credit card and all fees before you make a decision. First Progress offers the Platinum Prestige Mastercard® secured card. You will be charged a $10 cash advance when you withdraw cash with this credit card. Additionally, there is a 3% foreign transaction charge. The card also has a $29 late payment penalty if you fail to make a payment within six months.

This credit card is not a sign-up bonus, but it's a great option for those who want to improve their credit score. First Progress Platinum Select Mastercard Secured Card is not a signup bonus. However, it sends monthly payments to all major credit bureaus. This helps to reestablish credit scores and improve credit histories. First Progress Platinum-Series Mastercards also offer ongoing credit monitoring and $0 fraud liability. This credit card is internationally accepted. It can also be managed via an app or online.

No annual fees

The First Progress Platinum Prestige creditcard does not charge an annual fee. However there are some fees. If you delay your first payment, for example, you may be charged up $29 A $40 surcharge will be added if you fail to make six payments consecutively. This isn't exactly a deal-breaker, but it's something to keep in mind before you sign up.

First Progress credit cards don't require that you submit a credit score to be approved. Most credit card issuers will review your credit reports with the major credit bureaus when you apply. This is called a hard inquiry, and it can lower your score by a few points and stay on your credit report for two years. First Progress doesn't conduct hard credit checks. This means that your credit score will not be affected. First Progress makes use of a security bond to protect you against any defaults.

All 50 states offer this service.

The First Progress secured credit card is a revolving line of credit, based on the security deposit. You can apply for it in almost all countries, and there is no minimum credit score. The credit card fee for the year is $29, and it includes foreign transaction fees. Customers can apply online to receive their credit card in two to three days.

First Progress secured cards require applicants to provide basic identification information, such as their income and financial obligations. You must also be able provide a security deposits. First Progress won't conduct a credit check on you, which could damage your credit score. A card issuer will not inquire if the applicant doesn't have credit history. The approval process generally takes around three weeks. The lender is protected against loss if the security deposit is not received.

No hidden charges

First Progress is a credit card provider that offers full-featured accounts with a revolving credit line based on the security deposit. Customers signing up to the card should have a banking account. This helps them avoid having to pay separate payment vendors. Customers can pay their monthly bill via their bank account, which is another benefit.

The First Progress Mastercard credit card is fully-featured. This card allows consumers to establish new credit and pay their bills on time. It also reports to each of the three credit bureaus every monthly. After six months, the company offers its customers a second credit line.