Discover is a credit-card company that offers many credit cards. These credit cards are intended to build and repair credit. The company also offers rewards programs that allow you to earn cash back or miles for traveling. Learn more about Discover credit cards here. Discover can be used even without Facebook. Its privacy policies and terms of service are separate from Facebook and are displayed before you sign up for an account.

Discover is a credit card company

Discover is a popular credit card company, offering many credit cards. They offer a wide range of cards with no annual fees and great rewards programs. These credit cards are a great way to rack up cash back, flip your spending into a vacation, and build your credit score. Discover employs more 17,000 people. The company expects to make $5.4 billion by 2021.

Since the financial crisis, the company's shares have increased by more than 500%. This makes them one of the most successful financial stocks in the past decade. Discover Financial stock has lagging behind its peers and the overall market over the past one year.

It provides a variety credit cards to help you build or re-establish credit.

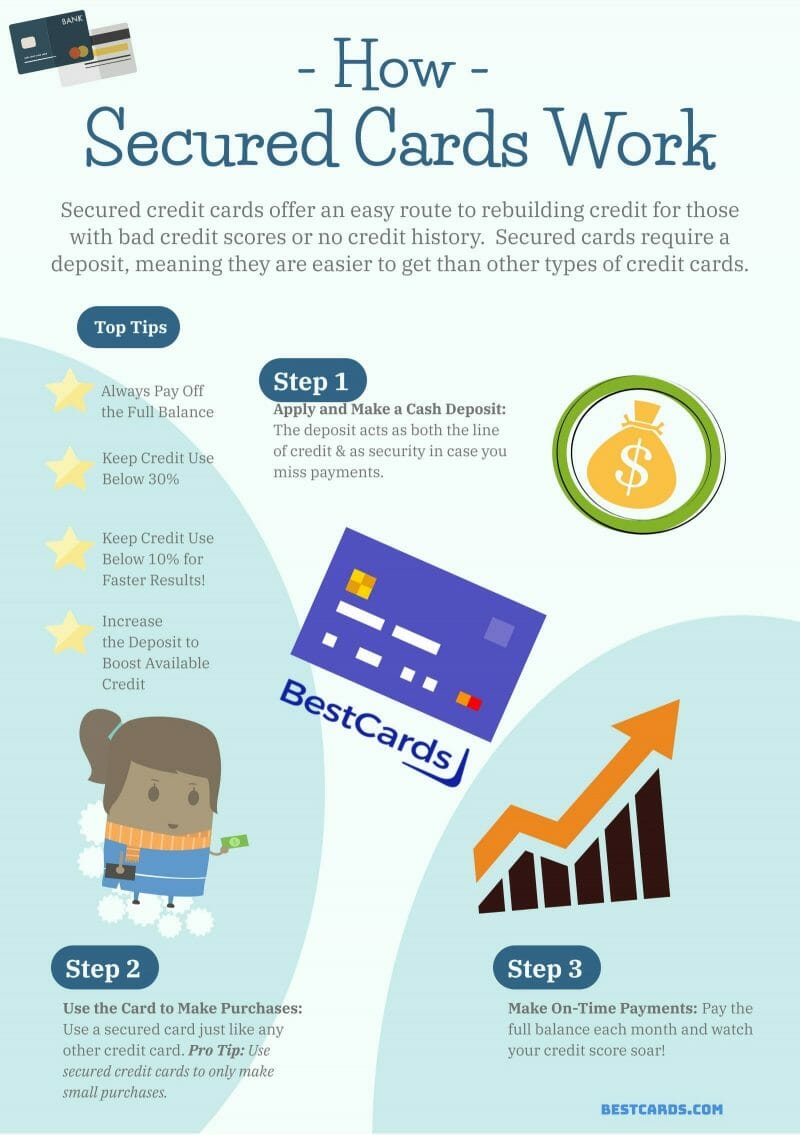

Credit cards with high credit limits and no credit limit are not recommended for those with poor credit. An alternative is to have a lower credit limit credit card and build credit through timely payments. This will increase your credit utilization ratio, and improve your payment history. It is best to wait several months if your credit history isn't great before applying for a secured credit card. By then, you will have a better credit score and be eligible to graduate to an unsecured credit card.

There are a variety of credit cards available from Discover, including a secured card that requires a deposit. This card is great for people with poor credit ratings who want to build their credit. While a security deposit can be a hassle, the Discover it(r) Secured Credit Card has a refundable security deposit that is returned once the card has been paid off.

It also offers cash back rewards

Discover offers cashback rewards for credit card holders who spend less than $500 each year in certain categories. The cash back rewards range from 1% to 5%, depending on the category. Cardholders have the option to set up email reminders and calendar reminders to remind themselves to activate bonus categories. Additional cash back rewards are available for purchases other than those in bonus categories.

Discover does away with late fees. Additionally, the penalty APR charged for late payments is not applicable to subsequent late payments. This is one credit card that gives you this kind of break. Another benefit of the Discover card is that it will match the cash back rewards you earn within the first year. You can get as much cash back as your heart desires, provided you responsibly use your card.

It allows you to travel miles

The Discover card can be a great way for you to earn miles on your travel. Redeem your points for any item you want, from hotels to flights. You don't have spend a lot of money to redeem your points. This makes travel costs much more affordable. You can also use your miles for gift cards or charitable donations.

You will receive a generous welcome bonus with the Discover card that matches any miles earned during your first year. This means that you could earn up to $700 in travel by spending three thousand dollars with this card. The card also offers 1.5 miles per dollar which is great news for frequent travelers. And since you don't need to keep track of rotating categories, you can earn miles anytime, anywhere.