There are many things you can do that will improve your credit score. These include paying your bills on schedule and keeping your credit utilization rates low. Also, it is important not to open new lines credit. These actions can have a negative effect on your score. New lines of credit also reduce the average age of your credit history, which is used in the calculation of your score. It is important to not close old accounts. This will allow you to keep your credit history intact.

Pay on-time

You can do a lot to improve your credit score by making timely payments on all your bills. Your credit score depends on your payment history. Inadequate payments can lead to a drop in credit score. For seven years, late payments will remain on your credit file. Make sure you contact your creditor immediately if you have missed a payment. If the creditor refuses to forgive you, make sure to request that they stop reporting late payments to the credit bureaus.

Your credit card balance can be lowered to improve your credit score. Your utilization ratio will be lower, which is the second most important factor that can affect your credit score. If you frequently use your credit cards, it is important to pay off the balance as soon possible. You may want to consider making payments on a biweekly or weekly basis. This will ensure that your balance is the lowest when creditors report on your payment history.

Keep your credit utilization rate low

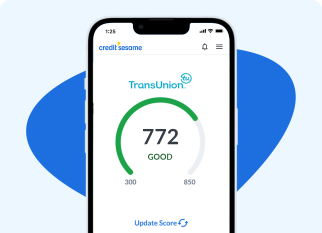

Maintaining a low credit utilization rate is one of the best ways to improve credit scores. Ideal credit utilization ratios of 30 percent and less are ideal. To find out your credit utilization ratio, you can either use a credit usage calculator or download a credit monitoring application to monitor it. If you have trouble keeping your credit utilization below 30%, here are some tips. By lowering your credit utilization rate, you can improve your credit rating quickly.

A great way to reduce your credit utilization is to pay off your credit cards in full immediately you receive your check. Credit card companies report your balance to the credit bureaus at the end of each billing cycle, so pay off your balance as soon as you get paid. You can also reduce your credit utilization rate by making multiple payments in a row.

Request a credit line increase

Be prepared to provide all necessary information before calling the credit card company in order to request an increase in your credit limit. The information you should provide includes your income, whereabouts, how much rent you pay, and what amount you would like to increase it. Be prepared to defend your request. This information can be used to support your request if you have a history that includes timely payments and responsible use your credit card. You can also mention a recent increase in your income as an explanation.

Some credit card companies allow you to submit your request online. Others require you to contact customer service. Sometimes, you may need to prove your eligibility. If you are eligible for an increase, you will likely receive an answer within 30 days.

Recover from a negative Credit Action

An initial step in recovering from negative credit actions is to review your credit report and look for errors. Consumer Financial Protection Bureau gets many complaints about credit reports that contain inaccurate information. For any errors to be corrected, it is essential that you carefully review every detail of your credit history. The process may take anywhere from six to nine month depending on your score. You may require more time to recuperate from negative actions if you have a lower score.

Depending on the type and extent of credit action taken, it could take up to six months for credit scores to improve. If the mistake is not a major one, the recovery time may be much shorter. Credit score improvement can take a few months of consistent, good behavior.

Reducing the number of inquiries to your credit report

An excellent way to increase your credit score is to reduce your credit inquiry count. Although applying for credit cards or lines of credit can temporarily lower your score it is crucial to keep your applications to a maximum of three per year. Hard inquiries on your credit report can lead lenders to consider you a higher risk borrower.

Most applications for credit cards or home loans require you to provide your credit history. These inquiries can damage your credit score. These inquiries may not have a major impact on credit scores, so it is best to minimize them.