You may be curious about what happens to your credit if you file for bankruptcy. While you cannot open a credit card immediately, there are many ways to rebuild credit. You can rebuild your credit following bankruptcy.

Rebuilding your credit score after bankruptcy

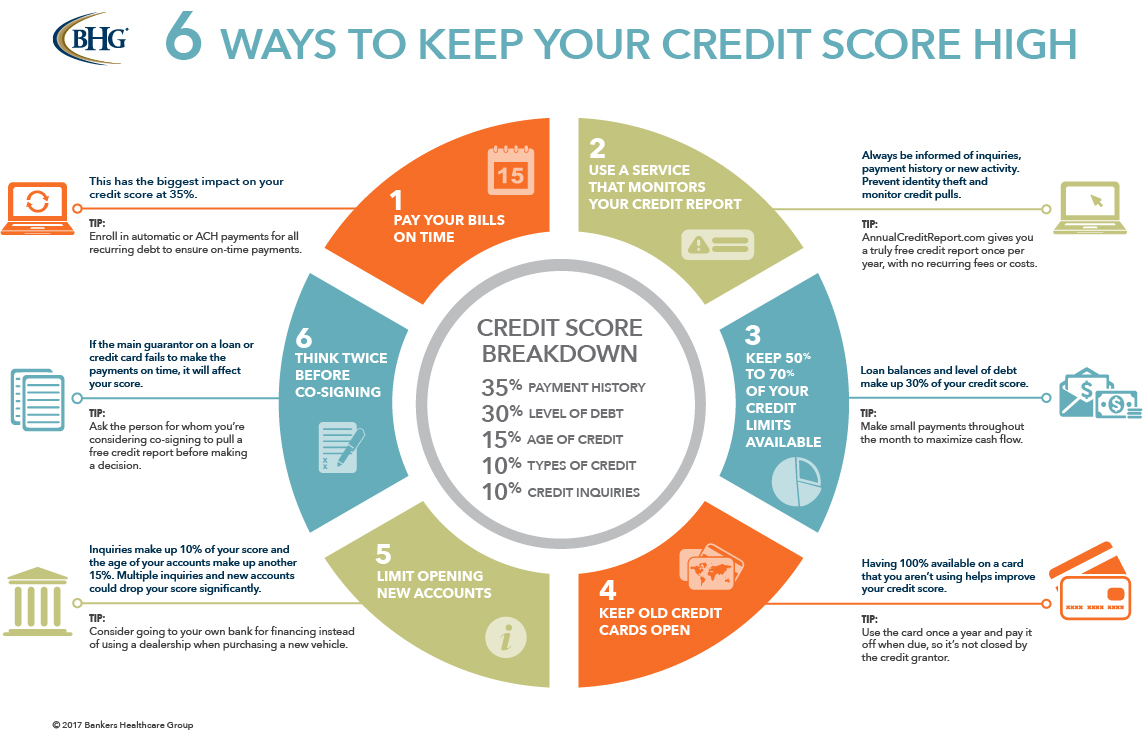

If you follow these steps, your credit score is sure to increase dramatically after bankruptcy. You must start by paying your monthly bills on time. This is very important since your payment history makes up 35 percent of your FICO score. Positive financial habits are also important to improve your score. You should avoid charging all your expenses on credit cards. Instead, choose one bill that you can afford to pay off in full every month. Once you're comfortable, you can open new credit accounts.

FICO scores can be affected by credit card debt. High balances should be reduced. To avoid future debt, you should also open an emergency savings account.

After bankruptcy, how to get a new credit line

Before you can apply for a new card, make sure you have paid off all your debts. Bankruptcy can have a negative impact on your credit score, and it will take anywhere from six months to five years to get your debt discharged. There are two options: chapter 7 bankruptcy or chapter 13. This will wipe out most of your debt. Chapter 13 (also known as a wage earner program) requires you to make monthly payment based on your income.

Once you have cleared your debts, you'll need to rebuild your credit score. This is crucial if you ever hope to get a mortgage or car loan. Your options with credit cards will be limited if your bankruptcy is filed. To avoid damaging your credit score, it is important to carefully read each card's terms and conditions.

Saving your home after bankruptcy

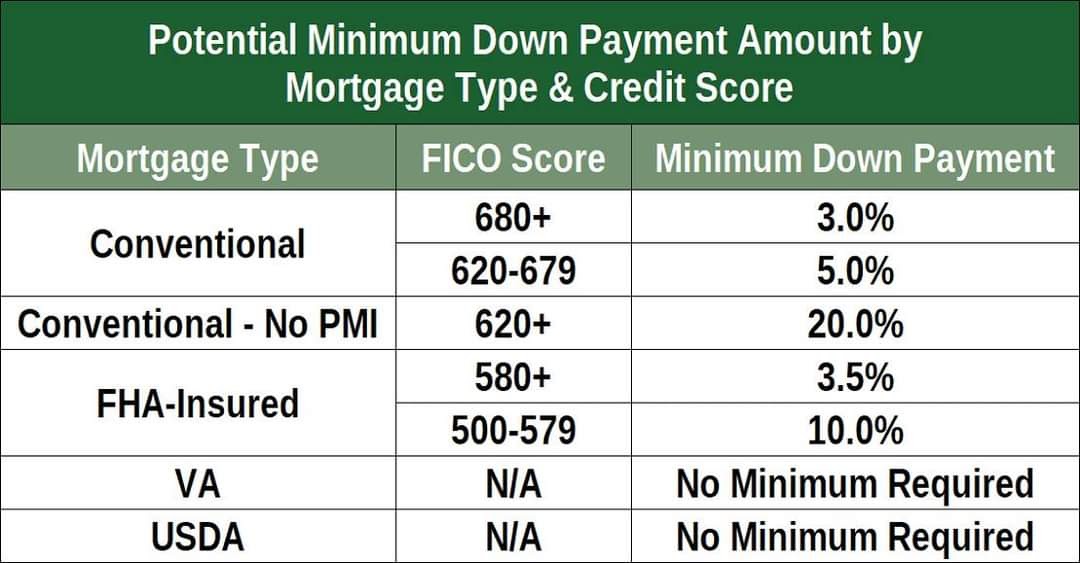

Refinance your mortgage after bankruptcy is an excellent way to save your home. You should consider all options and the potential risks before making such a huge decision. First, you need to know that bankruptcy can make it hard for you to get a mortgage. It is important to be prepared for large home maintenance costs, such as snow removal and landscaping. While this can be costly, it's important to plan in advance.

Also, file Chapter 13 bankruptcy for those facing foreclosure. While you are working on a payment program, collection activity will be stopped by filing for Chapter 13.