You should review your business credit report every year if you own a company to determine how well you are doing. This will prevent any problems which could have an adverse effect on your financial status.

A business credit report is a document that gives you information about your credit status in the business sector. It helps you make more informed decisions when it comes to financing, partnerships, and suppliers. Small businesses need these reports to protect themselves from fraud.

You can obtain a report of your business credit by visiting one of the three major commercial credit bureaus in the United States, Dun & Bradstreet and Experian. Creditors and lenders can use the information in your business credit report to determine whether you are eligible for credit.

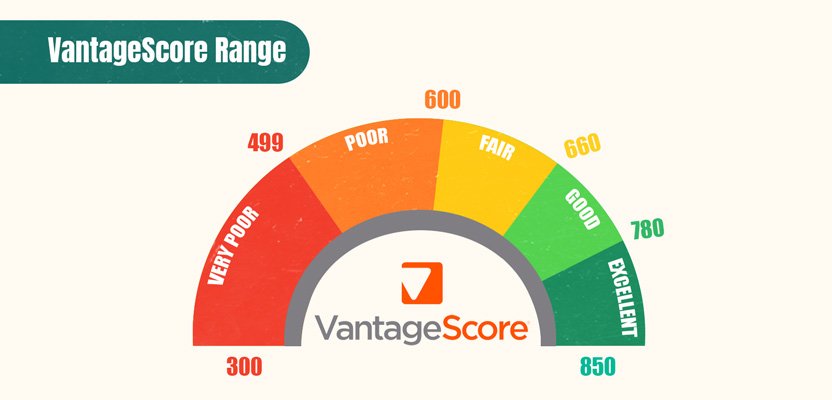

The information contained in your business credit report determines your score. It can range anywhere from 0 to 100%. Your business score determines your creditworthiness.

Your business's credit score can have a big impact on its bottom line. A high business score can also make it easier to qualify for a credit card or loan with a reduced interest rate.

The size of the business and the industry can have a significant impact on your credit score. You can increase your credit score by managing debt and paying on time.

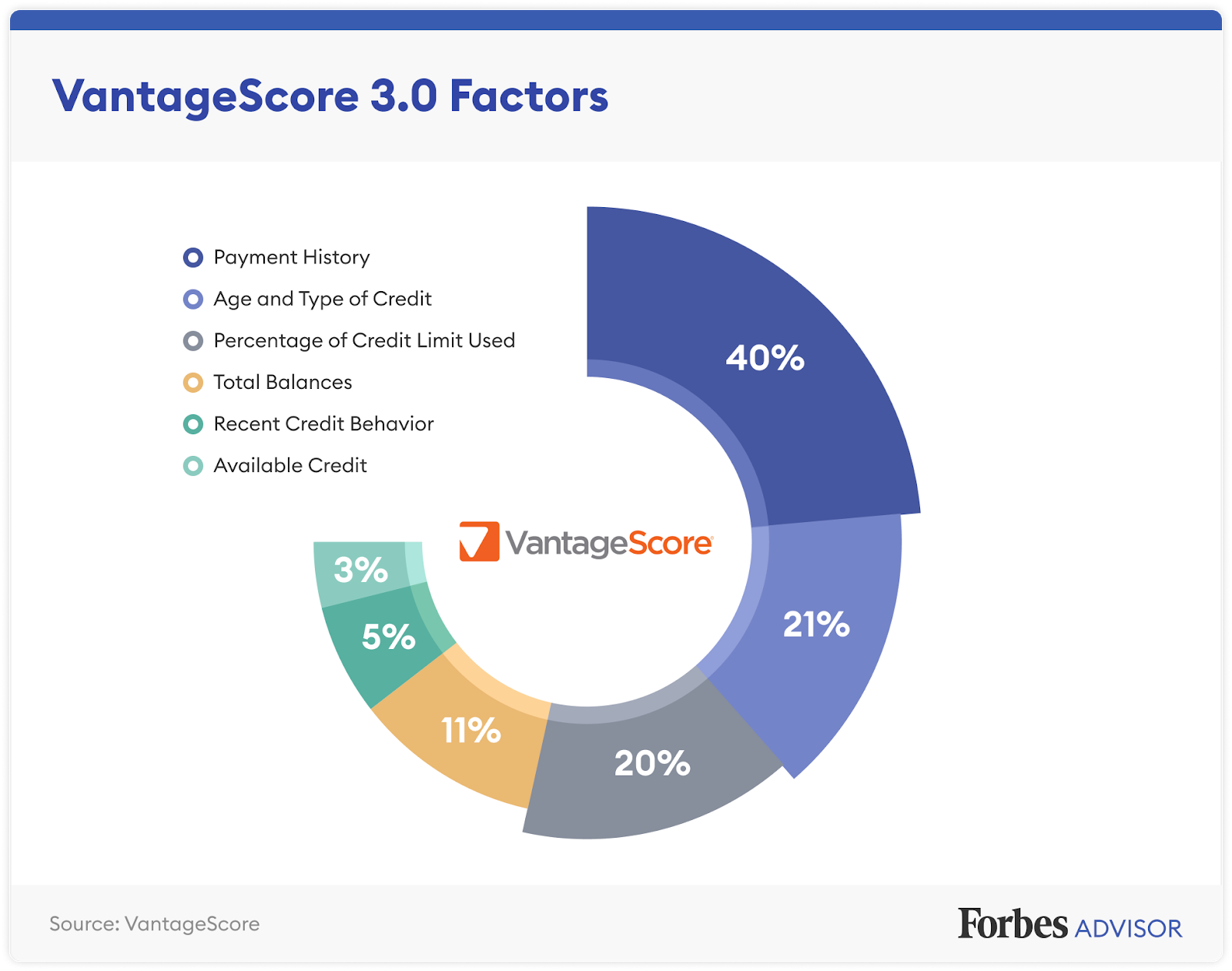

The information that appears on your report is collected by different companies. They use a variety techniques to evaluate payment trends and your business’s credit history. Also, they consider your public record and the demographics of your company.

Check your business credit rating regularly to spot potential problems. Some of these issues include inaccurate information, outdated or fraudulent data.

You can stay on top of credit by signing up for an online service that provides you with free access to business credit scores. These services may include an app or dashboard online that lets you monitor your business' credit score. They will alert you if anything changes.

Some of the services you can use to get a free business credit report include Nav, Dun & Bradstreet's CreditSignal and Creditsafe. These services provide a variety of features to help you monitor your business's credit score and credit history, including email notifications.

If you are a big company, it is a good idea to order a number of credit reports. Having several credit bureaus can help you maximize your credit score because all the agencies will have a more detailed view of your company's credit situation.

You will be asked to enter the name of the business you are ordering a credit report for, as well as the zip code in which it is located. You will be asked to answer security questions that will verify your identity.