An nRewards secured credit card is the best credit card to use if you're looking for a low purchase interest rate and no annual fee. This card also comes with a number of perks, including free credit score access and cellphone protection. It does not have foreign transaction fees. There is no late payment fee.

Sign up bonus not available

Navy Federal Credit Union's Secured Credit Card nRewards Secured Credit Card offers great credit cards that help build credit and allow consumers to earn reward points on purchases. It does not charge an annual fee or any other unnecessary fees, but you will need to make a $500 deposit into a qualifying NFCU savings account to qualify. You can get a credit line equal to your security deposit.

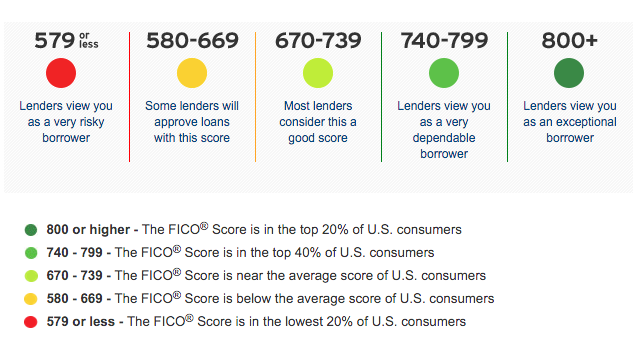

This card also reports your activity to the three major credit bureaus. These bureaus establish your credit score. You can also build a credit history by paying on time and get more favorable rates.

There is no annual cost

People looking to improve or build their credit score can choose a secured card with no annual fees. This card does not have a foreign transaction fee or a balance transfer fee. It also has no cash advance fees. You can also redeem rewards for merchandise or gift certificates with this card. Cashback rewards can often be worth one or two cents per point.

Navy Federal Credit Union nRewards secured card is intended to assist those with low or moderate credit in rebuilding their credit. The card must be used responsibly for at least six consecutive months in order to qualify for an upgrade. You will also need to deposit $200 in order to use it.

Consider the APR when searching for a secured bank card. APRs can be high on some cards so it is important to keep your balance low. It is also important to find one that reports to all three credit agencies. The best options will not charge an annual fee and offer rewards.

Low purchase interest rate

Navy Federal Credit Union can help you get a low purchase-interest rate secured credit card. You don't have to pay any foreign transaction fees. There are no balance transfer fees. And you can even get your FICO credit score. The card includes phone protection as well as the ability to make one late payment without penalty.

The purchase interest rate of a secured credit card is low, which makes it attractive for those who plan to use it for large purchases or consolidating other debt. A low interest rate will help you pay off your balance more quickly, and can also help you build credit for the future. The card may also come with contactless technology, which lets you pay at eligible point of sale terminals. In addition, it can be used to use Apple Pay, Google Pay, and Samsung Pay.

Navy Federal's new nRewards Secured Crt Card allows you both to earn rewards as well as build your credit. Despite the low purchase interest rate, you can make purchases on the card for any purpose and avoid paying interest for six months. This card is especially useful for those who are still working to build their credit history.