Capital One offers several credit options including the Spark Cash for Business card, Capital One platinum Secured Credit Card, QuicksilverOne and Capital One Platinum Secured Card. If you're interested in getting one of these cards, there are a few things you should know before you apply. First, decide which type of credit card you want.

Capital One Spark Cash For Business

The Capital One Spark Cash for Business credit card offers a minimum credit limit of $5,000. The credit limit will be determined by your credit score as well as the income you earn each year. If you make several on-time payment on your existing card, you may be eligible for a greater credit limit. Also, it is possible to combine many same-day inquiries to increase your chances of getting approved.

Although it is a business credit credit card, this card can also be used to finance large purchases. Businesses can benefit from the 0% intro APR when they purchase or transfer balances.

Capital One Platinum Secured credit card

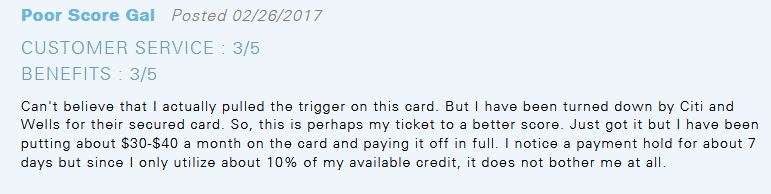

Capital One Platinum Secured credit cards may allow you to increase your limit if your payment history is good and you pay your monthly bill on time. In order to increase the credit limit, you must deposit at least $200 within the first six month of account opening. After this period, you will need to make a minimum of five payments on time.

At least $425 in monthly income is necessary to be eligible for a Platinum Secured MasterCard. If your income is too low, Capital One may reject your application and request you provide a security deposit. Those with a history of late or missed payments may also be turned down, but you will probably still be approved if you are able to keep up with the minimum payments.

Although you can build credit by using the Capital One Platinum Secured Credit Card you must keep your credit utilization under 30%. This is the second-most important factor in determining credit scores. A low credit limit can mean less spending and a higher utilization rate can result in lower credit scores. If a $200 card has a 30% credit limit, it means that the person can only spend $60. It makes credit building more difficult.

Capital One QuicksilverOne

If you're looking for a credit card with low interest rates and a low annual fee, the Capital One QuicksilverOne is the best choice. This card is a great option for credit repair because it has a low annual fee of $39, and you get 1.5% cashback on all purchases. The card doesn't charge a foreign transaction fees. This card doesn't require excellent credit like many other credit lines.

The Capital One QuicksilverOne card comes with a $300 credit limit. Even though this credit limit is modest, it won't hurt your credit score so long as your payments are on time. The total amount you owe is used to calculate your credit score, not the credit limit. If you make five or more on-time payments, you can request a higher credit limit. Capital One will consider automatically increasing your credit limit if the behavior is good for six months.

Capital One QuicksilverOne cash credit card offers a unique option for those with average to high credit scores. It has a rewards program that is straightforward and easy to use. You can earn 1.5% cash back for all purchases. Your rewards can be used to redeem statement credits and paper checks. While it charges an annual fee, it has a higher rewards rate than many other cards. It does not have a minimum spend requirement nor requires a security deposit.