There are several credit cards that can be used by students with bad credit. These cards can help you build your credit history. However, you won't have to pay high annual charges. But there are also some things to consider before applying for a card. For example, you should pay attention to annual fees and interest rates. Some cards charge a large annual fee, while others offer no rewards.

Students get rewards on their credit cards

A student card is a great option to build credit while you are in school. These cards offer valuable tools to track credit scores and monitor expenses. A sign-up bonus for student cards is often offered, which can be valuable in helping to pay for college expenses.

Students credit cards at attractive interest rates

A credit card should not have high interest rates. There are several options to accomplish this. First, you can get a card which does not charge an annual fee or a high foreign transaction cost. A card that isn't required to be shared with a parent/guardian is another option. However, students need to remember that this option may have additional requirements.

Annual fees for student credit card

Student credit cards are available with low annual fees for students. Many cards offer high quality purchase rewards. You should consider whether you can meet your monthly payment obligations. It may be a good idea to limit your credit to one card until you are more familiar with managing your credit.

Secured credit cards do not offer any rewards

Bad credit student credit cards can be a great option for people with low credit scores or poor credit. However, they generally do not offer any rewards or interest on the deposit. Some issuers will cancel your account if the required payments are not made.

Student credit cards with low limits

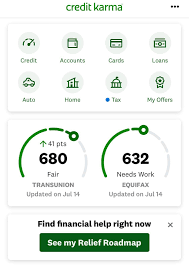

A student card with low limits may be an option for you if you have bad credit or need a credit card to cover tuition. Although these cards are not unsecured, they can help you rebuild your credit score. If you are responsible with your use of these cards, you can increase your credit score and be eligible for a regular credit card with better terms.

Apply for student credit cards for students with poor credit

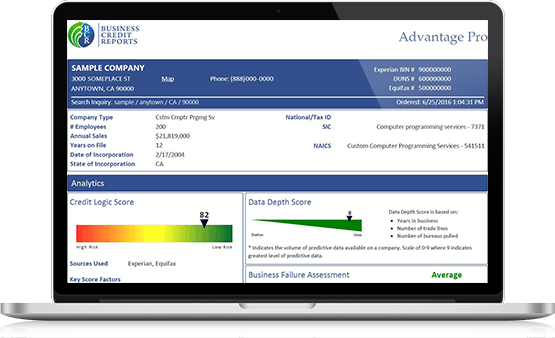

There are many options available for students with poor credit when it comes to student credit cards. Some will let you prequalify online. This is a great way to build credit. A credit card with good terms will help you improve your credit score and get you a better interest rate.