Petal is the credit card for you if your budget doesn't allow it. Petal's app gives you 1% cash back for purchases. There's also no annual fee so you can save money. You'll also get 24/7 customer support and convenience. Petal cards are open to everyone, even those without credit history. And it doesn't require a credit check, either.

Petal 2 offers Cash Back of 1%

Petal's Visa Credit Card "Cash Back, No Charges" sounds like a fairytale, but it really is not. Petal 2 Card requires a hard- and soft-pull during the approval process. Without a credit score, you won't be able to apply for this credit. The card can be applied for as long you are legal U.S. residents. This card can be used wherever Visa credit cards are accepted.

Petal 2 can be a great choice for anyone who wants to build credit or receive rewards. The card does not have an annual fee and offers rewards for regular payments. Petal 2 does NOT require a security deposits, which is a departure from other credit-building cards. The Petal 2 is not available to people with bad credit, bankruptcy or who have been insolvent within the last 48 months. The good news is the Petal 2 credit card does not have fees and can earn you statement credits and cash rewards with no credit checks.

Petal 1 requires no credit history

Petal 1 cards may appeal to those who have neither credit history nor existing credit. This card is designed for consumers with average credit who are new to credit markets and people trying to rebuild their credit. Petal is free of charge and a great option for students seeking a credit card. The credit card offers limited flexibility but comes with a low annual charge and other features that could be of value to you.

The card has a high maximum APR, and no cash back. The card does not charge any late fees. You can also use the card abroad without paying any fees. It offers a maximum credit limit of $5,000 There are no foreign transaction fees, and there is no monthly or annual fee. Petal can be a great choice for people who don't have credit histories, but may not be the best. If you have bad credit or no history, the Petal 1 Visa card may be right for you. Use it responsibly.

Petal 2 does not charge an annual fee

Petal 2 Card earns you cashback rewards for every purchase. On-time payments earn you 1.25% cashback for all purchases. Select merchants may offer up to 10% cash back. There is no annual fee so you don't have to worry about paying the minimum monthly payment. A mobile app is available for Petal 2 cards that allows you to search for merchants with higher reward rates.

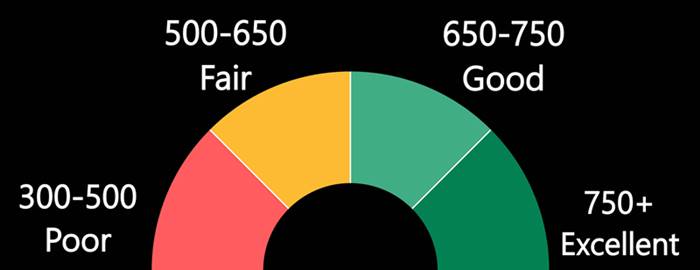

If you have poor credit or no credit history, Petal is the perfect card for you. To determine if you have a good credit score, this card uses a proprietary scoring method called Cash Score. Also, it considers your bank history which is often the reason for low credit scores. Petal helps you avoid high credit utilization and excessive debt.

Petal offers 24-hour customer service

When it comes to payment, one thing that makes Petal stand out is their 24 hour customer service. To contact customer support via the app if you have any problems with your account, please use the app. You can also see the offer and list of participating merchants in the app. Petal may have a different payment cut-off time depending on your location. You can also disable notifications to improve your experience. Customers can also call us for assistance if they aren't sure if they can pay with the accounts.

Petal offers 24/7 customer support and its main product, a credit card. Their qualification process is based primarily on the users' digital records. It takes into account their monthly incomes and expenses. Petal has different products for different customers, and these metrics are critical in determining whether a person is eligible for a credit-card. Responsible people will appreciate the lower interest rates offered by Petal's introductory products.