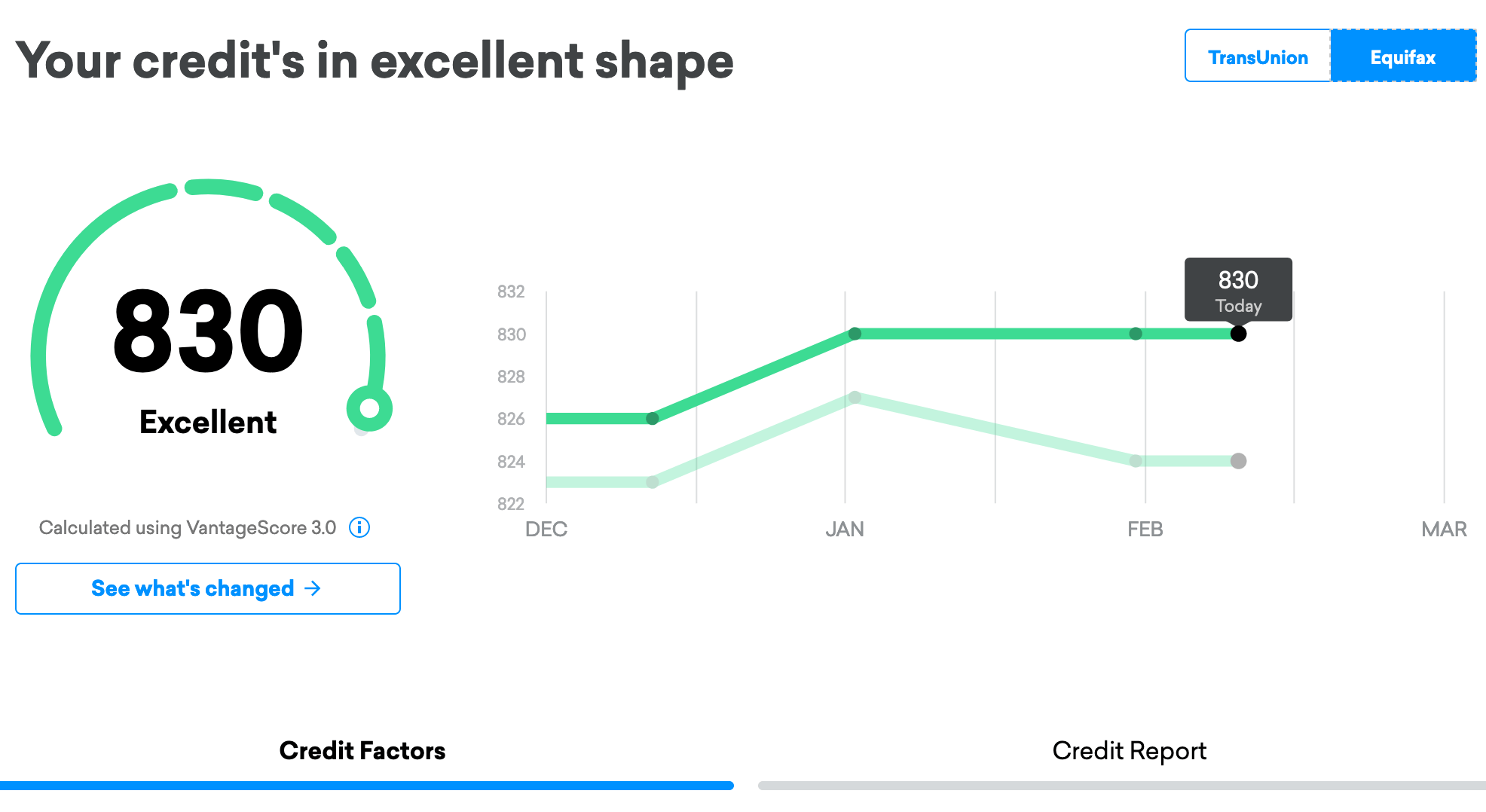

TransUnion and Equifax are the major credit score ranges. Experian is the third. Each bureau will offer a different score but they all use the exact same model. TransUnion's credit score ranges were developed using the VantageScore3.0 model by three credit institutions. Credit Karma does NOT sell your information on to advertisers. It uses your information only in order to recommend financial products for you based purely on your credit history.

Understanding credit score ranges

Before applying for a loan/credit card, you need to be aware of your credit score ranges. These scores help to determine the loan amount and terms a lender is willing or unable to lend. Different credit scoring models can impact credit scores. You may have a good VantageScore score, while your FICO score may not be.

Your credit score is a three-digit number that identifies your borrowing ability and will impact whether you are accepted for a loan or credit card. Your score tells potential lenders if you can pay back your debts and how likely you are to make payments. It is important to understand the range of your credit score and which factors influence it. Then you can assess your credit requirements and improve your credit rating.

In order to get a mortgage, your credit score is a crucial factor. Mortgage lenders consider many factors, including income, employment history, and debt-to-income ratio, but your credit score is one of the most important indicators. It is important to keep your credit score under control in order to get a good rating. It is important to keep track of your credit score so you can spot potential problems before they become serious. A sudden drop in credit scores could indicate identity theft or an error in your credit report.

Credit karma can be used to compare different options

Many people use credit scores from services like Credit Karma when shopping for credit cards and loans. These scores are not always accurate. Many people have seen their scores drop, even though they are actually higher than their actual. People then apply for credit cards or loans, believing they have excellent credit. But, the truth is that their credit score was actually quite low.

Credit Karma employs the VantageScore credit-scoring model. It also incorporates data from Equifax, TransUnion and Equifax. It can be beneficial to view multiple scores but you don't need to choose from more than one. Credit scores vary between reporting bureaus, and can be very different depending on the model.

Maintaining a healthy credit score

Your credit score can be a three-digit number that could impact your ability for loans and credit cards. Your credit score is a measure of your ability to pay back potential lenders. You can make smart financial decisions by knowing how your credit score compares to others and how you can improve it.

It is important to keep your credit score within the right range by regularly checking your credit score. This is especially true if your application for a loan, credit card, or other financial product involves credit cards. One mistake could cause your score to drop. Credit Karma, a free credit score monitoring tool that you can use to monitor your credit, will help you keep track of your credit and spot errors before they affect your credit score. You will need to know what your credit scores are if you want a mortgage or a home purchase.

Maintaining a good credit score will help you get approved for the best rates and terms. Lenders can deny applications if you aren't able to pay off your debts on time each month. You can avoid being denied by lenders by monitoring your credit scores and reporting on a regular basis.