You might wonder how to build credit credit without a bank card. Here's Bankrate's guide. Find out more about Retail credit cards and Secured cards. And make sure to pay your bills on-time. That will put you on the right track to building good credit. It's not difficult. It just takes time. But it is well worth the effort.

Bankrate's guide for building credit without a card

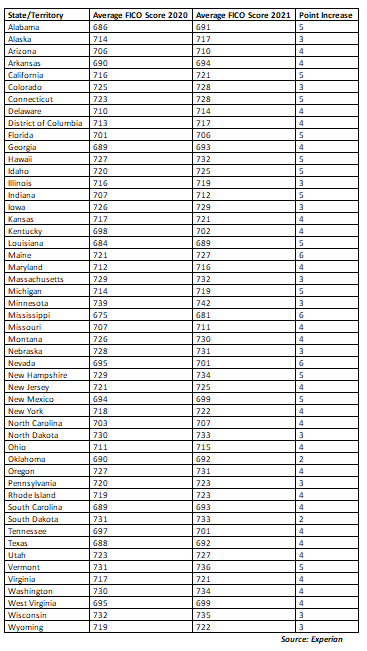

Even if you do not want to apply, you can still begin building credit without a credit score. Credit cards are the fastest way to improve your financial standing. However, 40 percent of Americans have a credit score below 700. This means you may not be eligible for new credit if your existing cards are exhausted.

Secured cards

Secured cards are a good way to build credit. You can use them to make regular monthly payments and increase your credit score. Secured credit cards send your monthly payments to credit bureaus. The good thing is that you do not have to pay an initial deposit to get a secured card. They work like a credit card and come with a revolving loan that you can replenish as you make payment.

Retail credit cards

Considering applying for a store credit card is a great option for people with bad or no credit. The cards are typically approved in minutes and can be used for purchases at the store or online. Some store credit cards are part a payment network that allows you to use them at any retail location. These cards can be a great way to rebuild your credit, and offer many benefits and rewards. But before you apply for a store credit card, think about how you'll use it.

Paying on time

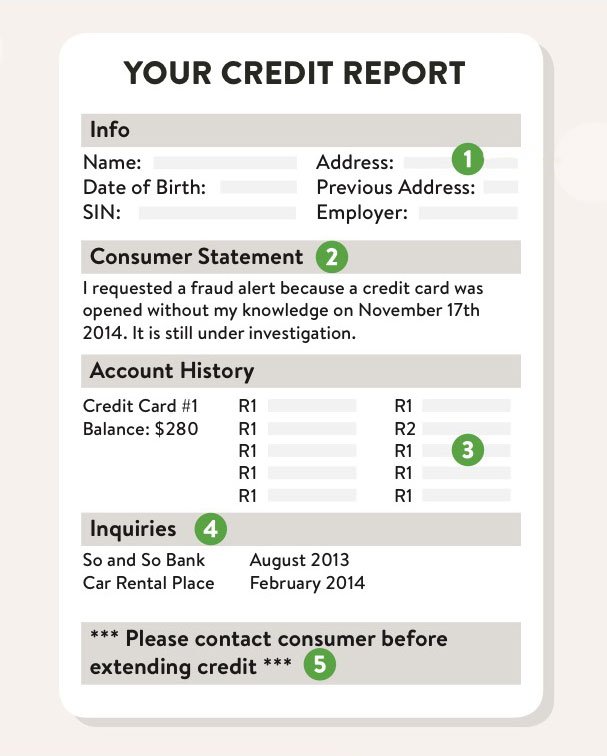

Building good credit with a credit card is important, but it is not the only option. You can raise your credit score by making other payments than credit card payments. It is possible to become an authorized user of a credit card owned by another person. You can also request that your credit report include an alternative payment history such as rent or phone bills.

Getting a credit limit increase

Some card issuers pull credit reports from you when you request a credit increase. But not all. The request you make won't have a negative impact on credit scores. You should be aware that a higher limit does have its benefits. However, you should also consider whether or not you can afford all the payments and repay your card fully each month. An increased limit will also have an adverse effect on your credit if you need to use the credit for large emergency expenses or refinance your debt, both of which may affect your score.