There are many ways to build credit, without having to use a credit card. These include personal loans, secured card cards, or Experian Boost. You can use personal loans for almost any purpose. You can even refinance your debt with a personal loan. You will need to have collateral as security for secured personal loans.

7 simple ways to build credit, without a credit card

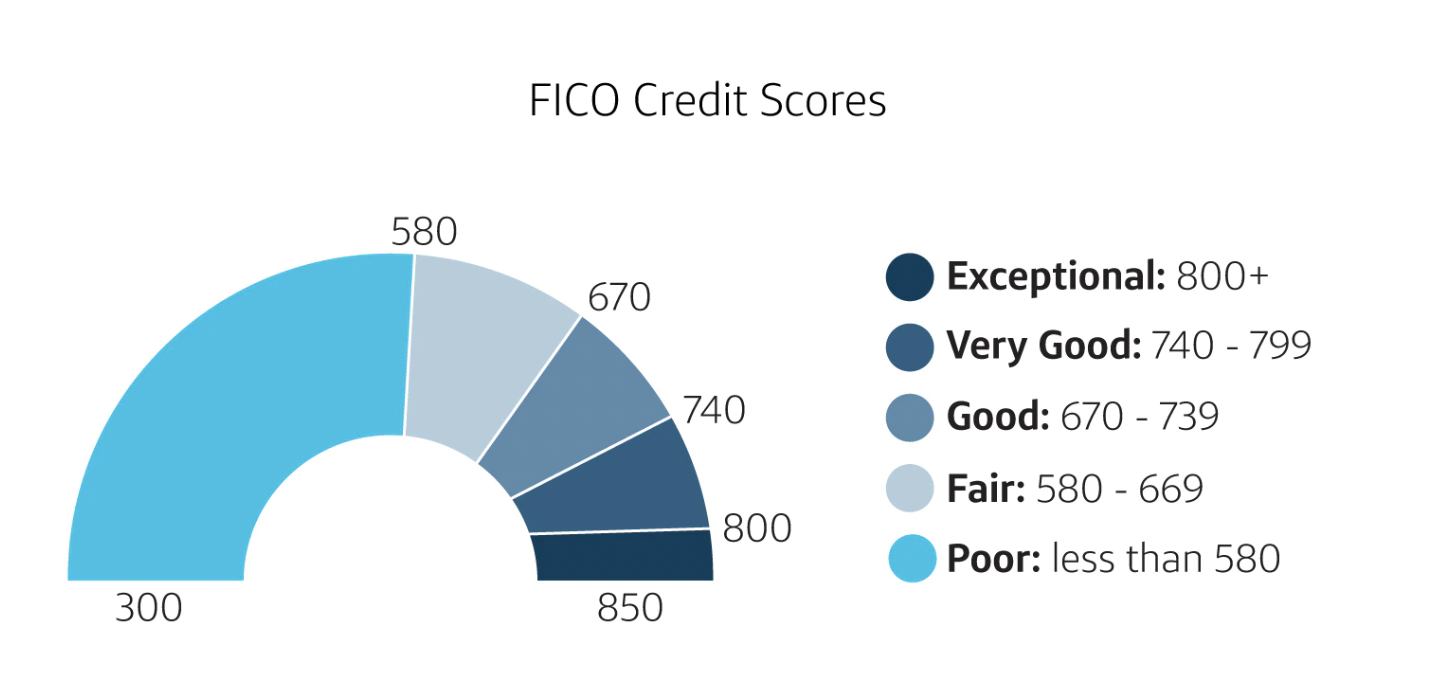

Building your credit without a credit card can seem like a daunting task, but there are ways to get started on the right foot. A store card, secured credit card or on-time rental payments are all ways to build credit. However, finding a lender to approve you for a credit card can be an uphill battle. This is because people with bad credit ratings don't have enough payments history to build a credit rating.

Although credit cards are an essential part of establishing credit, not all payments made on them will be reported to the credit bureaus. To establish credit, you can also use other methods such as asking for alternate payment history or an authorized user account on a credit card. These methods might not be visible to your creditors but they will improve your credit score.

Secured credit cards

Secured credit cards offer a great way for building credit without having to use a credit card. You may need to pay a monthly fee, but these cards can help you build credit and improve credit scores over time. You should not use the card for any other purpose than it is authorized. Also, make sure you pay the bill on time.

Citi Secured Mastercard is an excellent choice for anyone looking to quickly build credit, without the hassle of a traditional credit card. The card comes with a $200 security deposit, and you can choose your due date. It also reports all activity to the three major credit bureaus, and you can check your credit score for free online.

Personal

Personal loans can be a great option for those with poor credit scores. They help you establish a good payment history, which will be reported to the credit bureaus. Your score will rise if you make your payments on time. While it is not as easy as building a good credit score with a credit card, personal loans can be a good way to start building it.

Personal loans are convenient, but there are risks. The terms of the loan may include high fees and short repayment times. Some lenders won't report credit activity to credit bureaus. Personal loans can be more expensive than credit-cards.

Experian Boost

Experian can help you if you are looking for an easy method to build credit and avoid using a bank card. This tool connects your bank account and telecommunications payment histories to your credit report. This helps you improve your credit score and get better loan terms and interest rates.

To sign up, download a mobile app for free. After you have downloaded the app, you will need to upload a picture of yourself and your ID. This process takes around four minutes.