You may be wondering how to maintain a positive balance on your cards. This article will explain how to properly manage your credit cards' utilization ratio. This article will help you avoid fees, keep track and avoid late payment penalties. Continue reading to improve your credit score, and to learn how to keep track on multiple credit cards. Also, remember to pay your bills on time. It isn't difficult! There are many benefits.

Credit card utilization ratio

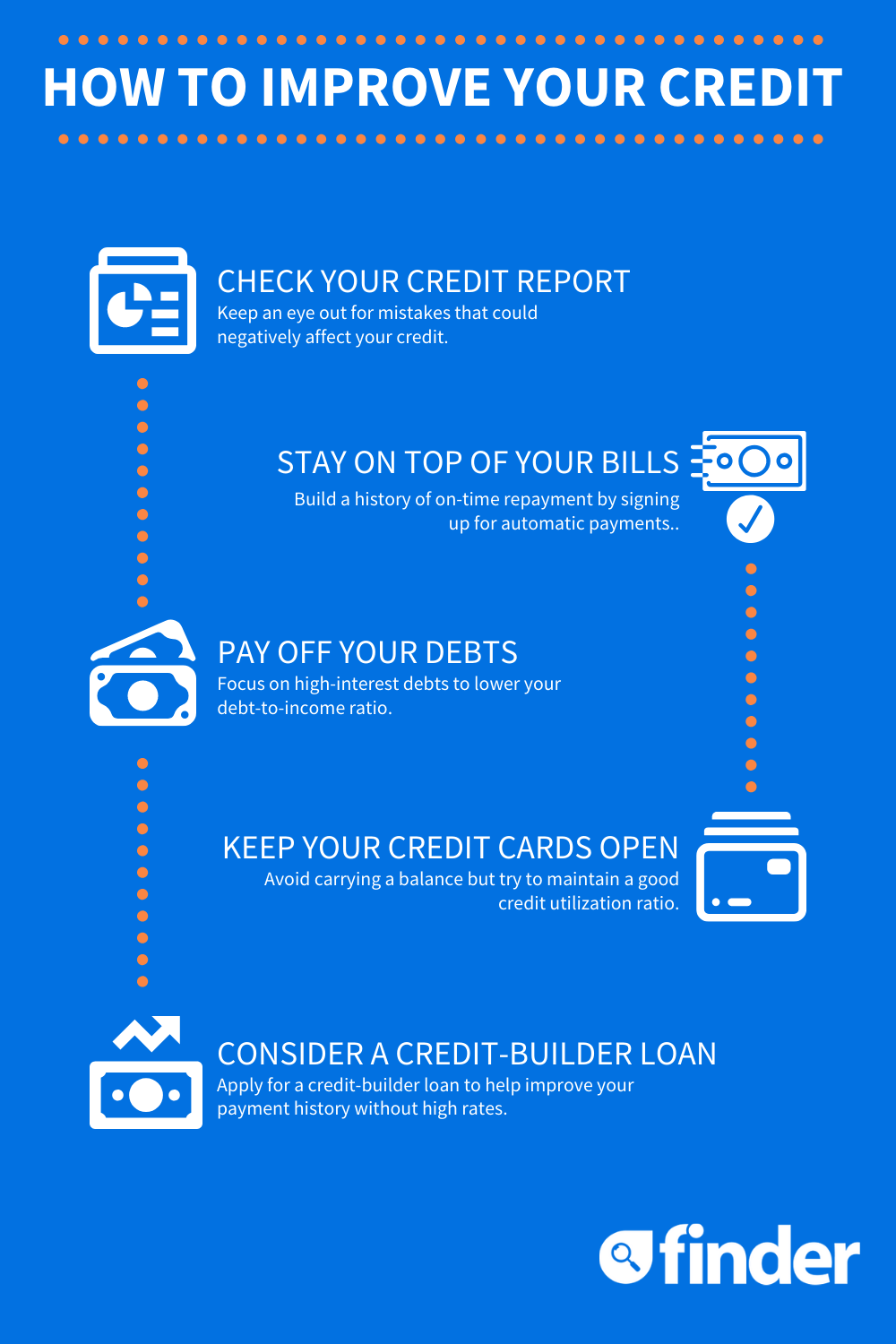

Your credit utilization ratio must be reduced to improve credit scores. This is based upon the credit limits and balances on your credit reports. Credit card issuers report this information directly to credit bureaus. This makes it unlikely that your credit score will show zero. You will see this amount on your latest statement. Each billing cycle, aim to repay your balance in full. If you can't pay your balance in full each billing cycle, then pay it off completely.

It is important to keep track of multiple credit cards

It is important to keep track of all credit cards you have. To avoid high interest rates and credit card debt, it is essential to keep track of your spending. It is important to pay off all credit card balances in full. This will show in your credit score. It is possible to keep track and manage multiple credit cards and credit scores if you are skilled in using them.

Paying your balances on-time

You can improve your credit score by paying off credit card balances on time. Different credit cards have different grace periods. You need to know when to pay your bills. Set up automatic payments and reminders to remind you to pay your balance. Avoid large purchases made with your credit cards, as they can increase the credit utilization rate.

Avoiding fees

It is important to understand the fees that credit cards can impose on you if you are a regular user. There are many hidden fees associated with credit cards, including late payment fees, foreign transaction fees, annual fees, late payments fees, and cash advances charges. These costs can be quite small, but they can add up to hundreds each year. You can modify the products or your usage habits to avoid paying these fees. For example, set up automatic payments for your minimum balance, full balance, or a custom amount each month.

Keeping a low credit utilization ratio

It is crucial to maintain a low credit utilization ratio on your credit cards and credit score in order to improve your financial health. The balance on your monthly statements is used to calculate the utilization. It is a great way to reduce your credit utilization ratio, and maintain a high credit score. You can check your credit utilization online for free on WalletHub. You can also reduce your total debt by making two to three payments each month.