When selecting a credit card, it is important to evaluate several factors. These include fees like annual or start-up charges and your spending habits. It is also important to consider your banking habits. A reward program might be a good option if you frequent your bank cards. Continue reading to find out which rewards program is right for you. You should also consider your credit rating.

Avoid paying excessive annual, start-up, and other periodic fees

Customers will often choose a different card than they are currently using due to high start-up and annual fees. These fees can cost hundreds of dollars each year. The annual fees for credit cards can vary from $95 to $500. This fee is generally charged once per year. Some credit cards waive this fee for the first year.

Another factor to consider when choosing a credit card is its billing cycle. Many cards have an annual fee, which can prove to be quite costly. But if the benefits outweigh the annual fee, the fee might be worth it. This is especially true when you are still building credit. This card can be beneficial even if you don't have good credit.

Understanding your spending

Understand your spending habits and make a decision before you open a credit account. Budgeting can help you determine your spending patterns. Plan to pay cash for certain expenses, rather than paying interest. It is important to keep track of variable expenses so you don't get into too much credit card debt. You can also make additional payments towards your card's principle. This requires more work and attention. The best credit cards are able to meet the needs of many people.

Understanding your credit score

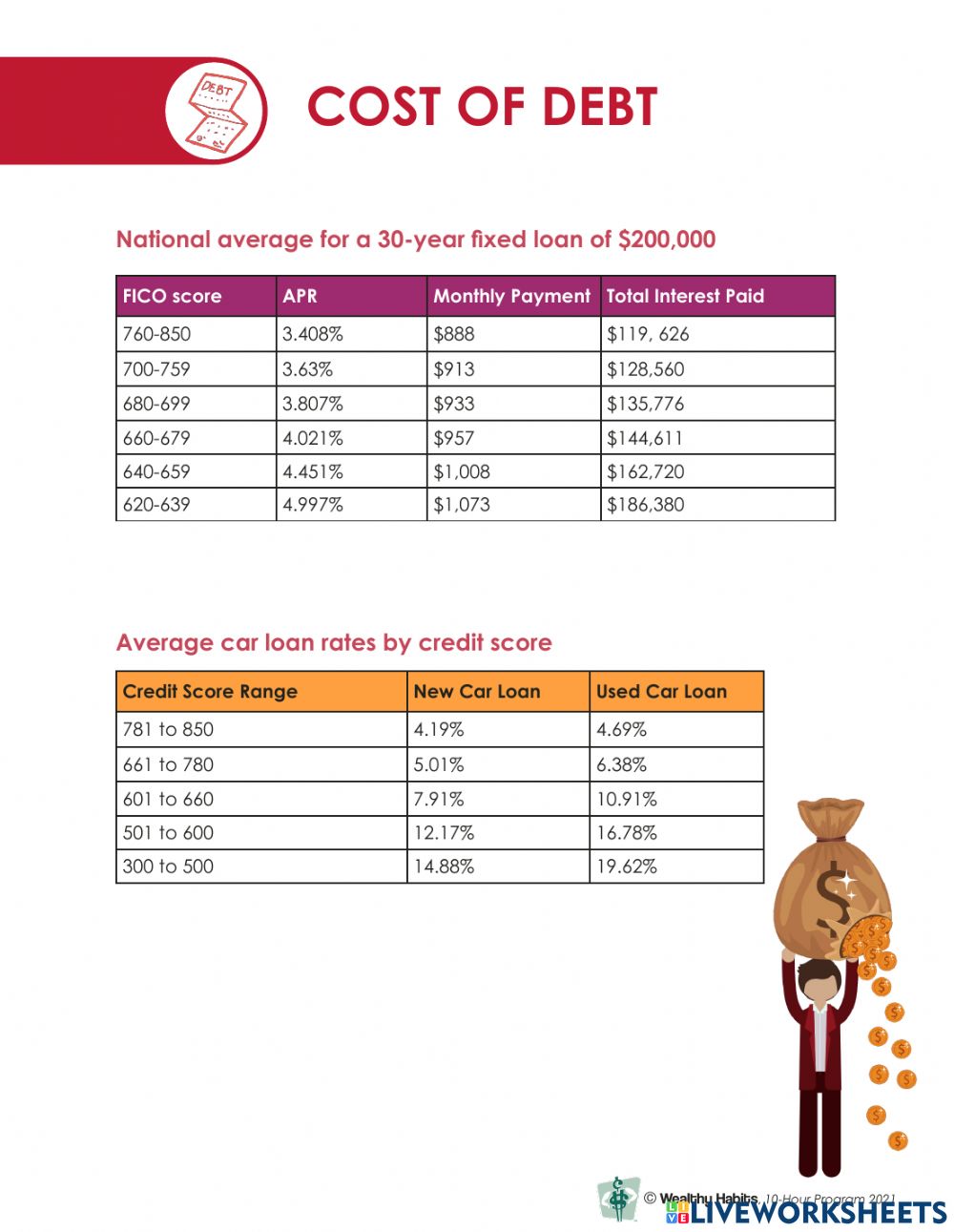

Creditors know a lot about your credit score. It is the sum and amount of your credit available. Higher scores translate into lower interest rates, and better terms for loans. By understanding your credit score, you can improve it over time. Most credit card issuers provide you with free access to your credit score. For your score, you can use either the FICO Score from Citibank or VantageScore (Discover) to access it.

When you are looking for a credit card, it is important to understand your credit score. Your credit score tells you how likely you are to pay your bills on time. This is also referred to as your risk score. Lenders will consider high credit scores to be lower risk. This means that you are more likely than others to get credit. Different credit scoring programs use different methods in determining your credit score. Nevertheless, knowing your score will help you choose the right credit card and make sure you pay your debts on time.

Understanding rewards programs

You need to be familiar with the details of these rewards programs before you can decide which one you want to use with a credit card. You can get points or travel rewards through these programs. Each card has its own terms and conditions. You should review your spending habits and budget to find the right rewards card. To earn the most points, a reward credit card shouldn't force you into impulse purchases.

Rewards programs can be a great way of attracting new cardholders but it is not enough to win their loyalty over the long-term. Understanding the root causes is crucial to overcoming this problem. Many consumers cite rewards as the reason they choose a credit card. However, many never redeem their rewards. This discrepancy between what consumers expect and what they receive should be noted by issuers. The results could make the difference between attracting customers and losing them.